Key Takeaways:

Current Price: $139 Price Target: $150

Position size: 2.74% 1-Year Performance: +3.6%

JNJ reported 1Q19 earnings results yesterday. Total organic sales were up 5.5% and adjusted EPS up +5.8% ex-FX. Top line was helped by high growth in Pharma (+7.9%) where pick up in new drugs demand is offsetting Remicade’s erosion. In Consumer, we were not surprised to see its baby care division suffer a decline in sales, partially due to destocking ahead of a relaunch outside of the US but also channel shift difficulties (most likely related to the online channel) and market softness in the US… The recovery we were expecting in Consumer has not found its footing quite yet. The Medical Devices segment growth profile has improved following the sale of its lower growth assets (Diabetes, ASP). During the call, the head of JNJ’s Pharma division commented on the change in the rebate rule being a positive for patients and thinks JNJ is in good position to succeed in the new environment. We have often times discussed the multiple lawsuits facing JNJ recently, but noticed the litigation costs dropping to $423M this quarter versus $ 1.3B in 4Q18, but still much higher than a year ago ($0). Overall we were pleased with the quarter.

Segment sales:

Pharma: +7.9%, growth driven by volume. In Oncology, Darzalex (+51%) and Imbruvica (+40%) gained market share. In Immunology, Stelara (+36%) and Tremfya lead the way in a growing US immunology market. Remicade continued its decline (-19% y/y) on increased biosimilar competition and a decline in discounts/rebates.

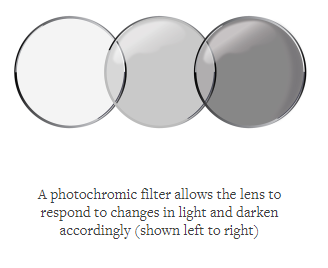

Medical Devices: +4.3%. Vision grew +5%, reaching $824M in sales in the quarter, thanks to their Oasys daily disposable lenses (see image below)

Consumer: +0.7%, Tylenol is back to being the #1 branded adult analgesic

2019 guidance update:

Organic sales up from 2%-3% to 2.5%-3.5%

Adjusted EPS growth up from 5.7%-7.6% to 6.7%-7.9%

During the quarter, Acuvue Oasys with transitions light intelligent technology became available in the US.

Valuation: no change

- Stock is supported by a ~5.3% FCF yield and a 2.58% dividend yield

Thesis on JNJ reiterated:

- High quality company with consistent 20% ROE, attractive FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

- Strong balance sheet that offers opportunities for M&A.

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109