Key Takeaways:

Current Price: $178 Price Target: $177 (NEW)

Position Size: 1.94% 1-year Performance: +30%

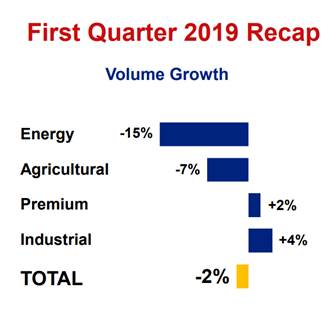

UNP reported a revenue decline of -2% (but with an average price slight acceleration from last quarter to +2.75% – enough to offset some cost inflation), and an operating ratio that improved 100 bps y/y, despite weather related challenges (160bps impact including lost revenue and increased costs). Heavy snowfall and flooding resulted in track outages affecting train speed and network fluidity, but the implementation of the Unified Plan 2020 (focused on asset utilization) is having a positive impact on freight car velocity, terminal dwell time and train speed. UNP’s operations proved more resilient to weather disruptions than it did in the past (our fear heading into the quarter). The outlook for 2019 cost savings is positive, with a step-up in net cost savings in Q2-Q4. We are raising our price target to $177 to account for a better operating ratio than expected.

Segment comments:

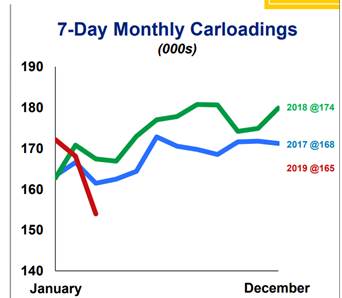

The red line in the chart below (2019 carloads) is one of the reason we trimmed UNP earlier.

Investment Thesis:

1. Pricing power: Railroads offer 4x the fuel efficiency of trucking per ton-mile of freight – a secular tailwind

2. History of compelling long term shareholder returns

3. Industry leading operating ratio and improving ROIC driving returns to shareholders via dividends/buybacks. Real shareholder yield of 6.5% (2.5% dividend yield, 4% buyback)

[tag UNP] $UNP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109