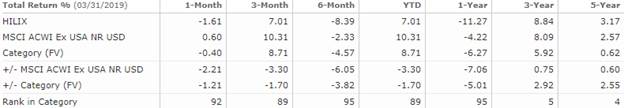

HILIX – Q1 2019 Commentary

The Hartford International Value Fund underperformed its benchmark during the quarter and has now lagged over the past twelve months. During Q1, underperformance was driven by stock selection in financials and materials. The team remains focused on long term results investing in companies that are out of favor but have strong balance sheets and growth potential.

Market Overview:

– International equities surged during the first quarter of 2019

o Markets were buoyed by productive trade negotiations between the U.S. and China

o Dovish rhetoric and policy actions from the major central banks

o U.S. delayed its plan to increase tariffs on $200 billion in Chinese imports

– Brexit remained a key area of concern with British parliament rejecting Theresa May’s deal for a third time

o Left further relationship between UK and EU clouded in uncertainty

– On the monetary front, the ECB surprised markets by pushing back interest rate hikes slashing its growth forecast and announcing an extended liquidity policy

Performance Overview:

– The Hartford International Value Fund underperformed its benchmark this quarter

o Driven primarily by stock selection within financials and materials

– This was partially offset by stronger selection within communications services and energy

– Sector allocation detracted from performance driven by overweight to communication services and underweight to real estate

– Geographically, holdings in the UK and South Korea lagged the most

o Holdings in Germany, Italy, and South Africa performed best

– From a style perspective, value significantly underperformed growth, creating a headwind for the strategy

– Top contributors included Saipem, Anglo American Platinum and Impala Platinum Holdings

o Saipem is an Italian oil services company

o Anglo and Platinum benefitted from platinum and palladium prices increasing during the quarter

Market Outlook:

– The team continues to focus on opportunities which fit into framework of looking for stocks with low relative price, low expectations, and low valuations

– Consistent with recent periods, energy, communication services, materials, and financials remain our largest overweight exposures

– Initiated nine new positions during the quarter and eliminated two full positions

– Team understands that value may continue to be out of favor but this does not change the approach of finding names that have strong balance sheets and significant upside potential

Performance Review:

[Mutual Fund Commentary]

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109