Current Price: $1,736 Price Target: $2,400

Position Size: 2.5% TTM Performance: -20%

Key Takeaways:

· Beat on bookings, slight miss on EPS, 2Q guidance a little weak. Room nights also better than expected.

· Gross travel bookings were +2% (+8% constant currency). Guidance was for +5-7% constant currency. So better than the high end of guidance.

217 million room nights booked in the quarter, which is up 10% YoY, also ahead of the high-end of guidance (+6-8%). Average daily rates were down 2%.

· Outperformance w/ bookings is an important positive because over the last several quarters they have been trying to “optimize” ad spend which has been resulting in weaker bookings. Their goal is to spend less on performance advertising (e.g. Google AdWords) and more on brand advertising (e.g. TV commercials). The idea is that brand advertising drives direct traffic to their site, resulting in a higher ROI. This ad spend/rev growth algorithm will continue to be a focus going forward as clearly the trade-off between growth and spend persist.

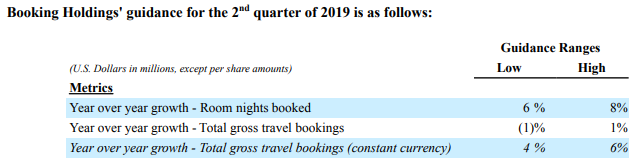

· Weak guidance: slightly disappointing Q2 booking guidance but they have a track record of conservative guidance – they almost always come in ahead of the high end of their bookings guidance on a constant currency basis. EBITDA and EPS guidance also a little light.

· Europe softening – the slow start to the year in Europe that they mentioned last call continues. Europe is a key market for them, so this is clearly a drag on their growth right now.

· FX headwind is expected to be significant this year. Current rates assumed in guidance reduces gross booking growth, revenue growth and non-GAAP EPS growth by 300 bps for the full year.

· Investing for growth: this will reduce their full year EBITDA growth by a few percentage points. This reflects increased spend on brand advertising, customer acquisition and incentive programs and spending to support their new payment platform. They are investing in a payment platform that supports non-hotel properties, and will facilitate growth in transport and local attractions business.

· Alternative accommodations: this is their business that competes with Airbnb and HomeAway. This is growing faster than their overall business.

Valuation:

· They continue to generate solid FCF with growing FCF margins. Repurchased $4.5B in shares YTD and plan to execute new $15B authorization over the next 2-3 years.

· The stock is still undervalued – they should produce over $5B in FCF this year, putting them at close to a 7% FCF yield.

Thesis:

1. Booking is a leading global online travel agent. Their global supply advantage drives a virtuous cycle: supply drives increased traffic and bookings and in turn more supply.

2. BKNG has several competitive advantages relative to Online Travel Agent (OTA) peers:

· Leading position in Europe is a structural advantage – market is highly fragmented and depends on OTAs for bookings

· They operate largely on an agency basis which allows them to continue to grow their network and do so profitably

· Strong position in China/South East Asia via Ctrip and Agoda

3. Booking’s addressable market is growing driven by: 1.) Alternative accommodations 2.)

Increased penetration (growth of mobile/internet) 3.) Global growth of travel spend > GDP.

4. Their asset light “toll both” business model is characterized by high margins, low capital expenditures, and growing free cash flow. Free cash flow is expected to grow double digits over the next few years and I expect them to put this capital to good use via continued investment in their business and/or opportunistic returns of capital.

$BKNG.US

[tag BKNG]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors