CVS held its Analyst Day yesterday. Overall the event was a mostly positive, as the management team provided greater details on their Aetna integration and long-term strategic vision. The main points of the day are highlighted below:

· Retail/HealthHub concept:

During the presentation, CVS focused on their HealthHub initiative. After testing 3 pilot stores in Texas, CVS concluded the concept is viable and will enter 4 new markets by the end of 2019, and ultimately open 1,500 Hubs by the end of 2021. The rapid expansion of the Hubs within its retail stores will allow CVS to incorporate this offering with the benefits design for healthcare plans nationally. Areas of opportunities are chronic care management, home hemodialysis, and analytics. These initiatives should drive $850M in operating income by 2022, and $2.5B longer term.

· PBM:

This part of the business continues to see some pressure, with net new business for FY20 currently at -$8.7bn. While it is not surprising to see some downward pressure following the merger with Aetna, we hope CVS’s guidance for a return to growth longer term will materialize sooner rather than later. There are a number of overhangs in this business that will continue to weigh on sentiment including the pending rebate rule. This should be partially mitigated by continued growth in specialty pharmacy and its new guaranteed rebate net cost model.

· Healthcare Benefits:

There is an opportunity to cross-sell SilverScript’s PDP members onto Aetna Medicare platform. On the Commercial side, management sees a low-single-digit revenue growth and high-single-digit operating profit growth in the near term, as the business remains competitive.

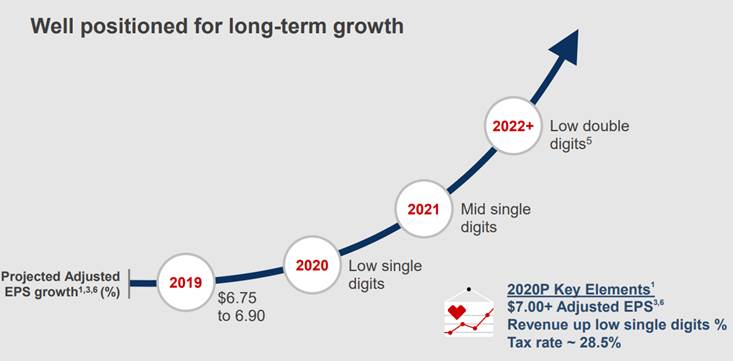

· Guidance:

The 2020 preliminary guidance is in line with expectations:

organic growth in the Health Care Benefits and Retail/LTC segments is partially offset by continued pressure in Pharmacy Services

at least $7.00 in 2020 EPS, representing a 2%+ growth vs 2019 estimated numbers, and EPS will be helped by debt pay down of $7.5bn through the end of 2019

CVS’s 2020-22 EPS growth targets relies on three cost-savings-oriented initiatives that are expected to drive $3.5 billion in earnings improvement by 2022:

1. Enterprise Modernization of $1.5-2.0 billion;

2. Aetna integration synergies of $900 million (vs. $750M previously announced); with $300-350 million in 2019, $800 million in 2020, and $900 million in 2021 and beyond

3. Transformation initiatives of $850 million.

· The enterprise modernization initiative and integration synergies:

CVS has set initiatives to reduce costs and improve productivity, which is expected to generate run-rate savings of $1.5-2.0 billion in 2022, which is separate is from the $900 million of integration synergies.

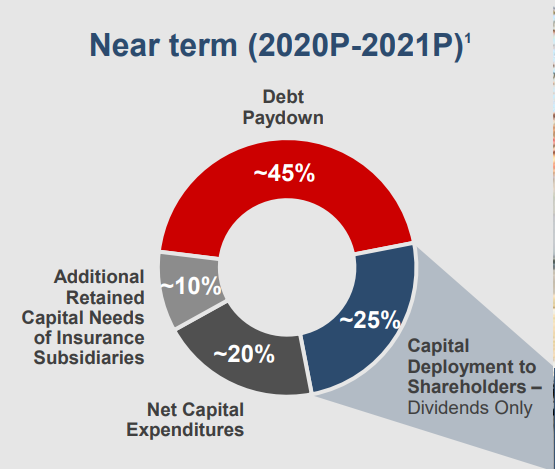

· Capital Allocation:

Management again pointed to a priority of using cash to pay down debt.

Management expects to generate $10-12 billion of cash to enhance shareholder value in the long term. Once leverage returns to the leverage target, capital allocation will shift to dividend growth, M&A and share repurchase.

[tag CVS]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109