TCPNX – Q2 2019 Commentary

The Touchstone Impact Bond Fund outperformed its benchmark during the second quarter, helped by its allocation to spread products, specifically corporates and MBS. The team is aware of the challenging environment but believes that a fairly strong U.S. economy and low global yields make the United States fixed income market a favorable place in which to invest.

Market Overview:

– The second quarter of 2019 was dominated by two primary macro themes – trade and central bank accommodation

o In addition to the deterioration in trade negotiations with China, Japan, South Korea, Mexico and the EU were all brought further into trade confrontations

o Domestic and global data signaled that the pace of economic growth was decelerating

– The prospect of slower growth, trade disputes, and central banks issuing lower guidance, sent interest rates lower during the quarter

– In this environment, U.S. Treasuries performed well, as did the riskiest sectors within the fixed income market

o Within U.S. credit, sector delivered excess returns over comparable U.S. Treasuries as domestic and global investors

o Global investors were willing to assume additional risk of U.S. bond in an effort to earn a positive yield; global bonds have nearly $13 trillion in negative yielding debt

– Overall narrative on trade weighed on risk sentiment, which was a headwind for spread products relative to U.S. Treasuries and corporate bonds

Performance Overview:

– The Touchstone Impact Bond Fund outperformed its benchmark, the Agg, during Q2

– Fund’s sector allocation benefited the portfolio

o Preference to complement Agecny Single-Family MBS with Agency Multi-Fmaily MBS benefited during the period

– Fund’s allocation to U.S. credit created a headwind on a relative basis as more cyclical and volatile corporate debt issuers delivered higher excess returns

o Relative overweight in the sector was a benefit as credit outperformed other sectors

– Largest contributors to the fund were Small Business Participation securities, Agency Multi-Family and Asset Backed securities

– Largest detractors were floating rate corporates, municipal housing bonds, and financial corporates

– Fund does not make any active interest rate bets and effective duration was approximately matched to the benchmark

– No significant changes to the fund’s positioning during the quarter

Market Outlook:

– Market sentiment has evolved dramatically recently and has a meaningful impact on the environment in which the fund is being managed

– In December, the widely held expectation was that interest rates would move higher

o Through the first half of 2019 investors appeared to expect rate changes were on hold and would be subdued

– As we now know, we have since seen the first rate cut from the Fed since 2008

– One benefit of the low rate environment is that it increases the attractiveness of spread securities, as the level of spread becomes incrementally a larger portion of total yield

o Fund’s overweight to spread products would stand to benefit if this type of investor reaction occurs

– Low level of yields globally, with $13 trillion in negative yielding bonds could potentially provide the fund’s portfolio with a tailwind as investors across the globe often need to go outside of their home country to get a positive return

o Due to currency hedging costs, investors are often forced into spread sectors

– Despite challenges, the economy is still growing, unemployment is low, wages are growing, and banks are well capitalized

o A strong economy is fundamentally positive for spread products

– If these items turn negative, it appears central banks across the globe are prepared to ease monetary policies

– The team’s bottom-up fundamental approach gives them the confidence that the high quality nature of the portfolio coupled with its spread advantage leave the fund well positioned moving forward

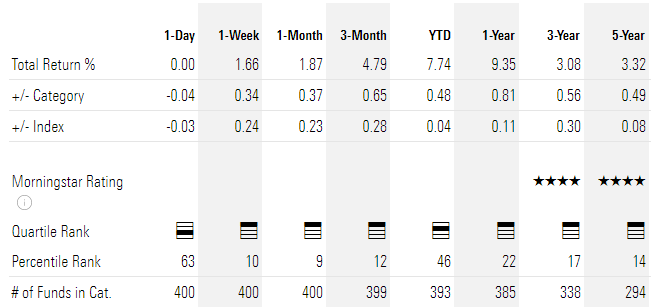

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109