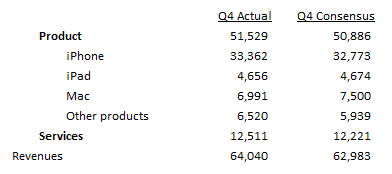

AAPL reported better revenue and EPS than estimates. Guidance for next quarter, which is seasonally their largest, was also ahead of expectations. By product, iPhone sales were down less than expected. They beat everywhere except Macs. However, for 2019 overall they generated the highest annual revenue ever for Mac.

Key Takeaways:

· Services growth accelerated to +18% and saw double-digit growth in all regions. They have several new services that aren’t making much of a contribution yet (Arcade, Apple News+, Apple TV+).

· Services segment accounted for 20% of revenue and 33% of gross profit. Positive commentary around launch of Apple Card. Apple Pay transactions more than doubled YoY to >3B transactions. Exceeding PayPal’s number of transaction and growing 4x as fast.

· Strong wearables performance (>50% growth YoY) driven by Beats, Watch and air pods. Set a Q4 records for Wearables in each and every market they track.

· iPhones declined 9% in Q4, but beat estimates (improvement from 15% decline they saw across the first three quarters). iPhone 11 is their best-selling iPhone.

· China improved – Greater China revenue at $11.1bn declined 2% Y/Y (up YoY in constant currency), improving from the 4% decline in FQ3. Management called out strong Wearables performance and double-digit Services growth as it saw more gaming approvals in the quarter.

· In general, they seem to be easing on iPhone pricing and it’s helping units. They lowered price points of the new lineup and have taken “lower exchange rates” in some markets internationally. Additionally, being promotional in the sense that customers can purchase their new iPhone with the Apple Card and pay for it over 24 months with zero interest and 3% cash back. With it they also get a year of free Apple TV+.

· Comment on tariffs: “We are paying some tariffs today as you know, some that went into effect pre-September, and some others that went into effect in September. So we are paying some that’s been comprehended. But in general, my view is very positive in terms of how things are going, and that positive view is obviously factored in our guidance as well.”

· They reiterated goal of being net cash neutral “over time.”

Valuation:

· Trading at about a 1.2% dividend yield, and ~5.5% FCF yield.

· They have about $103B in net cash on the balance sheet. That’s over 9% of their market cap.

· The stock is undervalued and substantial buyback from management’s goal of net cash neutral will support valuation.

· In addition to the >$100B in net cash they already have, they produce about $60B in FCF annually. That’s more than all the other FAANGs combined.

The Thesis for Apple:

- One of the world’s strongest consumer brands and best innovators whose product demand

has proven recession resistant.

- Halo effect -> multiplication of revenue streams: AAPL products act as revenue drivers

throughout portfolio – iPhone, iPod, MacBooks, iPad > iTunes, Apps, Software, Accessories,

- Strong Balance and cash flow generation.

- Increasing returns to shareholders via dividends and buybacks.

$AAPL.US

[tag AAPL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109