Key Takeaways:

Current Price: $75 Price Target: $115

Position Size: 1.28% 1-year Performance: -34%

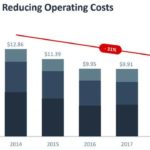

EOG released 3Q19 earnings that showed a miss on the revenue line by 2%, but lower costs than expected, with a drilling cost decline of 5% YTD. The premium drilling inventory level increased 17%. 1,470 premium locations were added, with the Wolfcamp M (combo oil/gas) and the 3rd Bone Spring locations. The negative material that came out of this quarterly report is that half of the premium drilling inventory is located in federal land, making it a risk if Elizabeth Warren were to be elected President (she had twitted this past year wanting to stop drilling on federal land). To somewhat offset this risk is the fact that the company has 4 years of permits in process (a permit typically takes 6-10 months to obtain). This regulatory overhang has been driving some of the EOG weakness this year.

Regarding its capital allocation, EOG is targeting a 2% dividend yield (from 1.5% currently), a sign of confidence from the management team in its future cash flows. About 2020 targets, EOG thinks it can achieve a 15% oil production rate, as long as the WTI oil price is in the mid-$50.

From an ESG standpoint, EOG provided some interesting data:

· It is the industry leader in capturing produced gas (vs. releasing it into the atmosphere)

· Remains committed in reducing greenhouse gas emissions, also a leader in this area

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

[tag EOG]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109