On 11/2/19, Berkshire Hathaway (BRK/A, BRK/B) reported Q3 earnings increase of 3.9% to $8.5b with strength in Insurance and Railroads. Sales increased 2.4% year over year. Berkshire’s collection of insurance companies and investments is unmatched and generates ~$8.8b in cash a quarter.

Current Price: $220 Price Target: $240 (raised from $225)

Position Size: 3.3% TTM Performance: 0.8%

Thesis Intact. Key takeaways from the quarter:

- Cash balances rose to hefty $128b or $50 a share for B class. BRK’s cash has risen from $60b in 2014. The high cash levels are a drag on earnings growth and have historically been criticized in the press. However, high cash levels are symbolic of Buffett’s patience as an investor and that market valuations are above average.

- Geico earnings rose, but saw similar profitability trends as Travelers with higher costs relating to severity of claims. Basically, the car insurance industry is paying more in liable claims which are dragging down profitability.

- Since 2018, headline earnings on BRK include unrealized gains on their equity portfolio. Before this mandated accounting change, gains were realized when positions were sold. When evaluating performance best to look at operational earnings which exclude the noise from changes in stock prices.

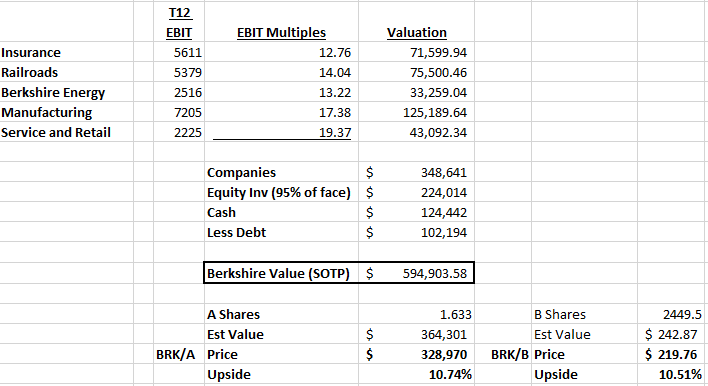

- Sum of the parts valuation is supportive of current price and suggests more upside, especially if excess cash is invested.

The Thesis on BRKB:

- Berkshire Hathaway has assembled an enviable portfolio of companies and investments that can compound book value per share in the mid-upper single digits.

- Negative cost of float gives it leverage to invest in stable companies that increases cashflow

- High cash levels put Berkshire in great position to deploy capital.

- Earnings from operating companies are stable and growing

- Berkshire is trading at an attractive valuation

Thanks,

John

$BRK/B.US

[tag BRK/B]

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109