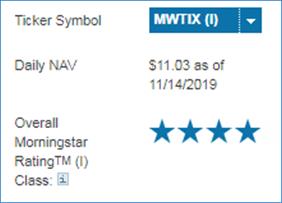

MWTIX – Q3 2019 Commentary

Overview:

The MetWest Total Return Bond Fund was approximately in line (slightly under) with its benchmark during the quarter, but has slightly outperformed during the year. The slight underperformance was heavily driven by the shorter duration positions during August, as well as the Treasury futures allocation. While falling rates and exceeding financial rates compared to yields created a lag for some of MWTIX’s holdings, other allocations in corporate credit brought positive returns.

Market Overview:

– During 2019, long-duration bonds brought higher returns as international tariffs and uncertainty continued

– Regardless of the Fed and ECB easing, the Agg returned 2.3% for the quarter

§ 25bps reduction in July, 25bps reduction in September, 25bps reduction in October

– The S&P 500 total return was 1.7% during Q3 2019, yet large differences existed between sectors

§ YTD, the S&P 500 is up over 20%, gaining almost 3.5% in October

§ Utilities were up the most at 9.3% for the quarter, while Energy was down 6.2%

– U.S. equities and fixed income markets have outpaced the returns of both developed and emerging markets

§ Barclays Agg up 8.5% YTD

§ Investment grade corporates up 3.1% for quarter, 13.2% YTD

– The Fed is not planning on raising rates until inflation reaches a consistent level of 2%

Performance Review:

– In Q3 2019, MWTIX underperformed the Barclays U.S. Agg Index by 3bps

§ MWTIX returned 2.24%, while the Agg returned 2.27%

– YTD, MWTIX outperformed the benchmark (Barclays Agg) by 37bps, mainly due to issue selection among corporate credit, which contributed positive returns over the quarter

§ Specifically the emphasis on manufacturing, non-cyclicals, and wireless communication, which were top performers during the quarter

– Securitized products had a slight positive impact

– Residential agency MBS contributed to positive returns due to sizing-up on position

§ Wider spreads and attractive valuations helped contribute

– Legacy residential non-agency MBS brought positive returns to the fund due to consistent demand and attractive fundamentals

–

CMBS and ABS had minimal impact due to yield premiums for the most part remaining unchanged

Market Outlook:

– Following a long expansion, current market conditions represent a late-cycle situation and downward pressure on growth

§ A flatter yield curve as a result of reduced incentives for financial intermediaries to expand their lending books

§ Uncertainty around trade policy and tariffs

§ Weakening business confidence

§ Falling ISM manufacturing

– Maintaining a defensive credit stance (minimal exposure) due to uncertainty in the more vulnerable issuers and industries

– Both positives and negatives weighed on Q3 which is creating on overall defensive outlook and strategy, looking for relatively attractive prices and reliable yields

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109