Current Price: $60 Price Target: Raising to $65 from $60

Position Size: 3.4% TTM Performance: 22%

TJX is up on a strong earnings report and raised guidance. They beat on revenue and EPS, with SSS up 4% vs guidance of 1-2% (which they lowered last quarter). Off-price continues to outpace the rest of retail. Management’s commentary on the call around their inventory positioning and general environment for Marmaxx was very, very positive. Full year SSS and EPS guidance increased.

Key takeaways:

· Revenue beat on same store sales of +4% vs expected +2.6%.

· Traffic was again the biggest driver of SSS. E-commerce sales are not included in SSS numbers.

· Marmaxx (their largest segment) – comp sales increased 4%, lapping a very strong 9% increase last year.

· International had the strongest SSS of +6% – they continue to take share despite the uncertainty of Brexit and a tough retail environment in Europe.

· GM were better than expected but offset by higher SG&A. Higher payroll costs and escalating freight expenses from rising home-furniture penetration are margin headwinds.

· Excellent inventory availability – specifically, mgmt talked about growing e-commerce channels being a source of inventory supply as online merchants struggle to appropriately gauge their own inventory levels – almost all the goods they’re selling on websites are imported goods with long lead times. They are trying to predict sales by category and item, but don’t have all the history that a brick and mortar retailer would have. This highlights part of TJX’s competitive advantage – their scale and centralized merchandising. The efficacy of this is reflected in high inventory turns, which allows them to be very liquid and very opportunistic w/ inventory buys. They buy in season and continuously flow merchandise to stores.

· Tariffs – Q4 guidance includes small negative impact from tariffs. Thus far, they have benefited from vendors buying in merchandise earlier due to tariffs, which has resulted in more availability for TJX. But given TJX’s high turns, they buy-in inventory on a much shorter-term basis, so they don’t have visibility yet into 2020 and the potential impact from tariffs. They do not directly source a significant amount of goods from China.

· M&A – They disclosed a $225million investment in 25% of Familia, a major (275 store) off-price apparel/home retailer in Russia that could double its store base in the next 3-5 years. They are Russia’s only major off-price retailer. TJX may take a larger stake in the future.

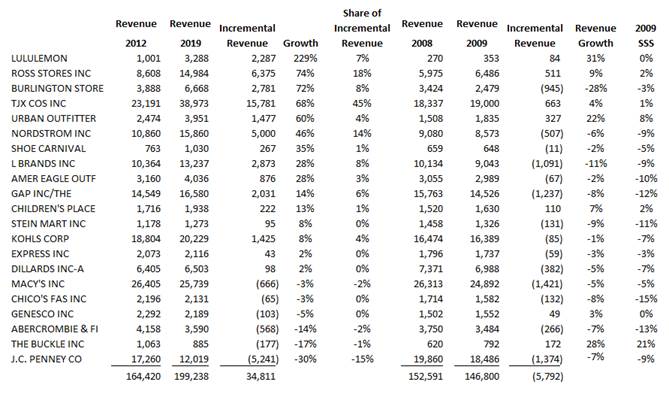

· Chart below demonstrates TJX’s resistance to e-commerce and economic cycles. Despite the ramp in e-commerce share of retail over the last several years, of the companies listed below TJX is nearly half of aggregate incremental spend. The companies listed below represent more than 2/3 of the ~$275B in US apparel retail sales. Additionally, in the ’08 to ’09 period they were one of few retailers that continued to grow and post positive SSS.

Valuation:

· Balance sheet is strong. They have no net debt.

· Store openings will bolster top line growth. This fiscal year they plan to add 230 net new stores, representing 5% store growth.

· They have been steadily FCF positive, even through the financial crisis they posted 3% FCF margins. LT FCF margins are ~7%.

· They plan to buyback ~3% of their market cap this year (fiscal 2020).

· Valuation is reasonable at ~4% forward yield.

· Increased dividend 18%… 23rd consecutive year of dividend increase. Dividend yield is 1.8%.

The Thesis on TJX:

· Market leader: opportunity to benefit from a lasting paradigm shift in consumer frugality. Treasure hunters – TJX has strong brands that attract cost conscious consumers– evident through consistently strong customer traffic.

· Strong bargaining power with suppliers due to size.

· Quality: Solid and consistent execution and top line growth driving strong margins through cost cutting/inventory control.

· Shareholder returns: Strong returns, balance sheet and cash flows being used for share buyback program, dividend, and store expansion.

$TJX.US

[tag TJX]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109