HLMEX – Q3 2019 Commentary

Overview:

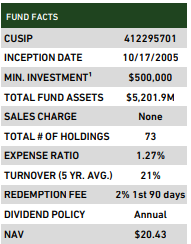

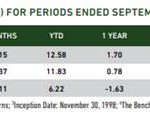

The Harding Loevner Emerging Markets Equity Portfolio outperformed its benchmark during the quarter and YTD. Outperformance can be mostly attributed to strong performance of high-quality stocks, as well as weighting, where HLMEX was underweight materials and overweight IT. Stock selection was also strong in IT and healthcare which helped returns.

Market Overview:

– Emerging Markets fell in July and August due to escalating trade tensions between U.S. and China and global slowdown, but slightly recovered towards the end of Q3 as governments and central banks implemented monetary stimulus actions

§ Optimistic note at beginning of Q3, White House lifted ban that prevented U.S. companies from working with Huawei

§ 10% levies added on Chinese goods due to disappointing agricultural purchases by China

– MSCI EM Index dropped 4% for the quarter which lagged developed markets by 500bps

– EM currencies fell to the U.S. dollar

§ Return of dollar-denominated EM index lags local currency version by almost 2% YTD

– Worldwide conflict and tension has caused EM growth to slowdown, yet IT has remained resilient (gaining 6% which outpaced developed market IT sector)

§ TSMC large part of this as the company issued better than expected guidance

– Consumer discretionary and staples outperformed, but returns widely varied across countries

– Materials had lowest performance, falling 11%, due to weak numbers from steel producers and Asian petrochemical companies

– All EM regions posted negative returns for the quarter

§ Europe performed best (-2%)

§ Africa performed worst (-11%)

Performance Review:

– EM fell 3.2% for the quarter, which outperformed its benchmark (MSCI EM Index) by 90bps

– YTD, HLMEX has returned 12.2% which is almost double its benchmark’s return

– Underweight to materials and overweight to IT, along with good stock selection in IT and healthcare aided relatively strong performance

§ Sunny Optical (China) & Largan Precision (Taiwan) rose due to rising demand from high end smartphone makers

§ ASM Pacific Technology rose (Hong Kong) due to TSMC’s increased guidance

§ CSPC & Sino Biopharmaceuticals (China) reported strong revenue growth

– Financials and consumer staples detracted returns due to weak performance

§ Financials: Hong Kong Exchange and AIA Group (protesters brought city to standstill at times), Discovery Holdings (sell off of government announced plan), Itau Unibanco and Banco Bradesco (decreased GDP growth projections)

§ Consumer staples: Pau de Acucar (declining margins), Amorepacific (failed to increase profit margins)

– Regionally, performance boosted by lack of exposure to Saudi Arabia and Argentina, and over-exposure to Russia

§ Underweight to Taiwan market detracted

Market Outlook:

– Focus on understanding a company’s business models and competitive advantage instead of forecasting GDP growth for a region

– Economic Complexity Index (ECI)

§ Help to understand a county’s growth potential and economic development

§ EM countries are becoming more than just suppliers of resources and manufactured output of inexpensive labor

– China, the largest EM, continues to grow by diversifying its exports

– South Korea, Thailand and other Asian countries continue to develop by improving their supply chain and manufacturing

– Brazil, Peru, Colombia, and South Africa have stagnated/regressed in regard to ECI due to their commodity-oriented economy

– Continue to implement fundamental, bottom-up research to identify firms that dominate their local industries

§ Not reliant on global trade to sustain business

– Advancements in technology allow for EM to grow and progress

§ Recently the embracing of technology has proved successful with headway being made in digital banking, advanced real-time data analytics to improve supply chains and customer services, and e-commerce

– Cash flow return has seen increases, and expect to continue for EM investments

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109