Key Takeaways:

· 4Q19 results were better than expected as content growth story continues (Sensata’s strategy is to grow the amount of sensors used in a car over time – by making more sensors that answer a manufacturer’s need to comply to changing regulations for example)

· Coronavirus impact on 2020 results was clearly quantified by the management team, which lifted some concerns on the name

· 2020 guidance showed the power of the company’s strategy, even when end-markets show some weakness

· Sensata is still attractively priced, with a FCF yield of 5.3%

[more]

Current Price: $50 Price Target: $61

Position Size: 2.10% 1-year Performance: +2.4%

Sensata released 4Q19 results, with organic sales contracting -0.8%, better than guidance and expectations, thanks to strength in its Industrials segment. Free cash flow was better than guided and in line with the prior year, reflecting a better conversion rate from net income. This past quarter, operating income was impacted by sales deleverage, some productivity headwinds and design & development investments. During the year, ST reduced its share count by ~5%, a wise capital allocation decision by the management team in times of high M&A prices and a stock price still attractively priced.

Segments review:

· Automotive organic sales decline of -1%: Sensata outgrew this sector by 490bps, thanks to strong content growth in China (double digit growth), but negative impact of the GM strike in North America and softness of European exports to China

· HVOR organic revenue growth was -2% y/y: Sensata outgrew this sector by 1190bps, thanks to content growth in China as OEM prepare for the implementation of the China VI regulations

· Aerospace & industrial: organic growth was +1%: thanks to the double digits aerospace growth

The management team provided guidance for 2020 of -1% to +2%, reflecting the impact of the coronavirus on factory closures and supply chain disruptions ($40M sales impact and $20M operating profit hit that will not be recovered later in the year). Without this one-time (hopefully) event that is the virus outbreak, sales and profits would have shown a return to stable demand, which is what consensus was expecting. 1Q20 will be the weakest with -8% to -6% organic growth (Coronavirus impact). The management team assumes global auto market production to decline 5% y/y, China auto down 6% y/y, and the global HVOR market down 9% y/y.

The Thesis on Sensata

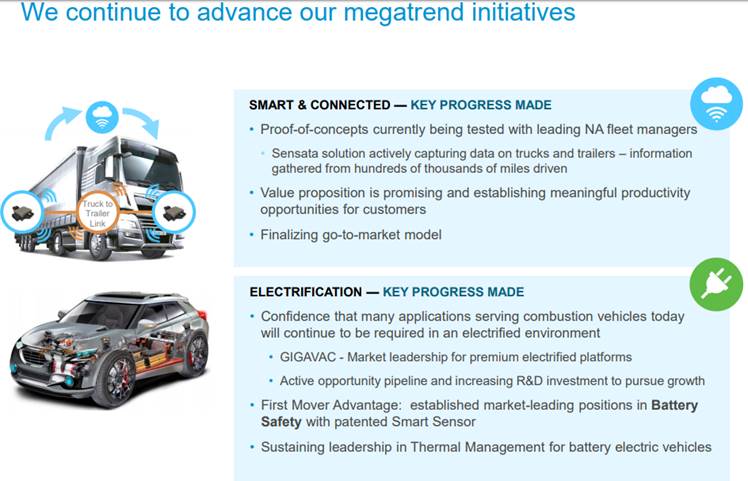

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109