JPIN Commentary – Q4 2019

Thesis

JPIN’s focus on risk weighting enabled us to replace a market cap weighted index while still gaining exposure to international developed equity markets without deviating too far from the benchmark. Utilizing a multi-factor approach of value, quality, and momentum, JPIN has generated alpha through strong stock selection over time. Additionally, the fund helps diversify risk by weighting across 40 regional/sector buckets based on rolling risk statistics, which ultimately increases our exposure to active share and our risk-adjusted returns.

Overview

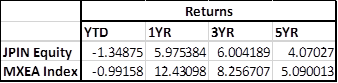

In the last quarter of 2019, JPIN outperformed the benchmark (MSCI EAFE Index) by 26bps. Momentum and Quality factors helped contribute to returns in addition to offsetting a weak quarter for the Value factor. Over 2019 JPIN returned 15.70% which lagged the benchmark (does not include Korea) by 6.16%, but when compared to the FTSE Developed ex North America Index (includes Korea), JPIN trailed by 5.63%. Central bank shifts and trade tensions were the main drivers for the underperformance for the year, as both Korea and Japan heavily detracted from returns.

Q4 2019 Summary

– JPIN returned 8.43%, while the MSCI EAFE Index returned 8.17%

o FTSE Developed ex North America Index returned 8.54%

– Overweight to Korea helped returns as the region outperformed due to cooling trade tensions

– Underweight to Germany detracted from returns after the country produced rebounding and improving economic data

– At the sector level, overweight to consumer goods generated returns and overweight to utilities hurt returns

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s multi-factor approach, consistency in asset allocation, and historically strong stock selection

– Going forward JPIN continues to see the Value factor as an attractive area, while Momentum and Quality factors performed well during the past quarter

– As trade tensions ease, overweight to Korea has the capability of producing strong returns

o Growth in semi-conductor business as 5G continues to roll out and technology expands

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109