HILIX Commentary – Q4 2019

Thesis

Serving as a satellite holding, HILIX is a value style fund that takes advantage names that have underperformed recently and are cheaply priced. The team generates alpha by finding companies with strong fundamentals that are overlooked during times of low consensus expectations. We like that HILIX takes advantage of extremes and gains exposure to less efficient market caps by having more holdings and moderate active bets.

Overview

In the last quarter of 2019, HILIX outperformed the benchmark (MSCI EFEA Index) by 2.45% due to strong stock selection in the financials, energy, and industrials sectors. Through a bottom-up approach, sector allocation in information technology and healthcare detracted from returns. The fund did make a few changes during the quarter by adding to energy and communication services in Norway and Germany, respectively, and selling out of consumer discretionary and materials in Japan and South Africa, respectively.

Q4 2019 Summary

– HILIX returned 10.62%%, while the MSCI EAFE Index returned 8.17%

– Contributors

o Selection in financials, energy, and industrials

o Overweight to information technology and underweight to healthcare

o Stock selection in Developed Asia Pacific ex Japan

– Detractors

o Selection in consumer discretionary

o Underweight to utilities and real estate; overweight to materials

o Stock selection in Japan and Developed Europe and Middle East ex UK

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s value and bottom-up, fundamental approach

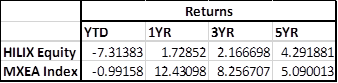

o YTD the fund has taken a heavy loss due to poor performance by the Value factor in International Developed markets

– Going forward HILIX has most of its overweighting in information technology and energy, while being strongly underweight healthcare and utilities

– EM and Japan are the most invested in regions and Europe and Asia Pacific ex Japan are underweight regions

– Value has been underperforming for some time, yet historically it has proven to outperform

o Value has been at a low and may produce outperformance as it reverts to the mean

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109