LISIX Commentary – Q4 2019

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

Overview

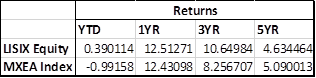

In the last quarter of 2019, LISIX underperformed the benchmark (MSCI EFEA Index) by 1.25% mainly due to strong cyclical sectors (industrials and semiconductors) while defensive sectors lagged (consumer staples and telecom). Additionally, energy stocks continued to be weak as oil price stayed the same and carbon-related divestments increased. Healthcare, on the other hand, posted strong returns as U.S. political tension and risk eased.

Q4 2019 Summary

– LISIX returned 6.92 %%, while the MSCI EAFE Index returned 8.17%

– Contributors

o Industrial sector with the help of ABB’s choice of new CEO and Ryanair’s market stabilization

o Financials sector thanks to National Bank of Canada’s strong results and Prudential’s improved sentiment around Hong Kong

o Volkswagen reported positive earnings surprise

– Detractors

o Less cyclical industrials lagged overall

o Compass reported weak European trading

o Alcon (healthcare stock) extended margin targets

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s strong stock selection and expertise in various market caps, geographies, and sectors

– Going forward LISIX’s strategy is starting to shift towards more value-oriented names

o Large valuation and performance discrepancy between growth and value stocks

o Short-term economic momentum expected, driven by lagged effect of low rates and geopolitical relief

– The managers are cautious of any possible monetary policy offsetting which could disrupt market pickup

o To avoid volatility the managers will continue to search for stocks with sustainably high or improving returns, trading at attractive valuations

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109