HLMEX Commentary – Q4 2019

Thesis

HLMEX utilizes fundamental research to find companies with strong quality and growth metrics that can be compared across the global landscape. By focusing on investments with competitive advantages, long-term growth potential, quality management, and corporate strength, HLMEX offers diversity to our EM allocation while generating alpha over the long run. We continue to hold the fund because of the team’s conviction in high quality companies and managed risk through diversification and evaluation.

Overview

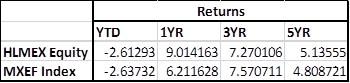

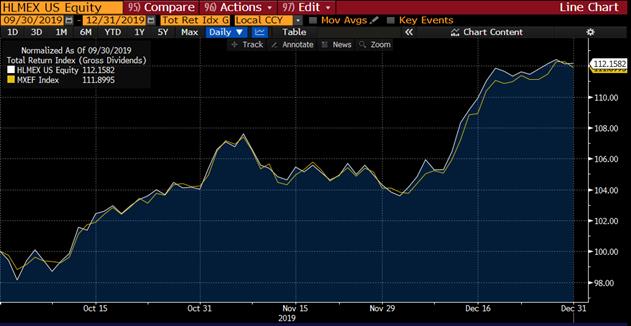

In the last quarter of 2019, HLMEX outperformed the benchmark (MSCI Emerging Markets Index) by 32bps through strong stock selection in Industrials, Communication Services, and Consumer Staples (even though Consumer Staples was a detracting sector). De-escalation in the U.S.-China trade war, central bank easing, and an overall decrease in global recession fears helped contribute to strong EM returns for the quarter. For the year, HLMEX outperformed the benchmark (MSCI Emerging Markets Index) by 6.95%.

Q4 2019 Summary

– HLMEX returned 12.16%, while the MSCI Emerging Markets Index returned 11.84%

– A new Chinese-based holding in Industrials was added to the portfolio

– Industrial-based companies in Brazil, China, and Russia helped contribute to returns

– Financials in Russia and Columbia helped contribute to outperformance

– Consumer Discretionary in South Korea, Indonesia, and India detracted from returns

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s focus on quality by emphasizing earnings growth and strong cash flow to gain attractive returns over the long run

– Going forward HLMEX will continue to hold an overweight in Financials and underweight in Materials

– The managers see a lot of opportunity in Artificial Intelligence (AI), explaining an increased overweight in IT

– Increased exposure to India following the corporate tax reform announcement

o Sign the Government is willing to take further action to boost the economy

– Widened underweight to the Middle East

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109