TIREX Commentary – Q4 2019

Thesis

TIREX utilizes fundamental research to find properties in high barrier markets, with higher occupancy and rent growth. By focusing on quality companies and avoiding unnecessary risks, the fund obtains a strong track record that has outperformed the benchmark and REIT ETF over time. We continue to hold TIREX because of the team’s growth focus with asset concentrations in supply constrained markets. Lastly, TIREX was the lowest cost active manager screened, at 51bps.

Overview

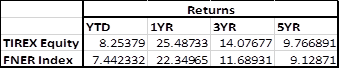

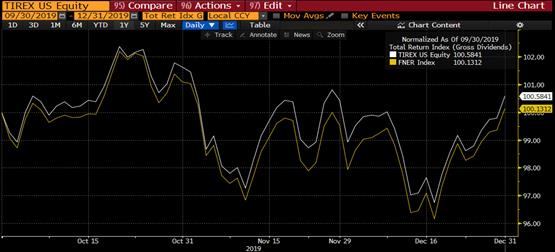

In the last quarter of 2019, TIREX outperformed the benchmark (FTSE Nareit All Equity REITs Index) by 45bps, focusing on long-term, growth-oriented REITs with strong balance sheets. The fund remained cautious toward sectors that historically require heavy capex. Additionally, TIREX continued to trim outperforming positions and reduce underweights in companies that share characteristics with the late stage of the economic cycle.

Q4 2019 Summary

– TIREX returned 0.58%, while the FTSE Nareit All Equity REITs Index returned 0.13%

– The fund remained focused in manufactured housing, industrials, and data centers

– The fund remained cautious of properties such as offices and shopping centers

– Contributors

o Data center REIT based in China and office REIT based in the U.S.

o Underweight position in health care REIT based in the U.S.

– Detractors

o Not owning an industrial and a diversified REIT, both based in the U.S.

o Being overweight in a shopping center REIT based in the U.S.

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s goal to obtain long-term alpha through capital appreciation and current income

– By having a research-oriented investment process that focuses on cash flows and asset values we believe TIREX will continue to outperform its benchmark long-term

– The managers are effective when it comes to understanding and preparing for changes to the cycle and the effects of growth and value rotations

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109