Key Takeaways:

· 4Q19 results were better than expected

· 2020 guidance reflects conservatism due to current oil prices: greater focus on cost reductions and less so on oil production growth

· Dividend increase of 30% reflects management’s conviction in their premium strategy. Even if oil prices dip below $40/barrel, EOG can cover its dividend without issuing equity

Current Price: $62.3 Price Target: $87 (NEW)

Position Size: 1.22% 1-year Performance: -36%

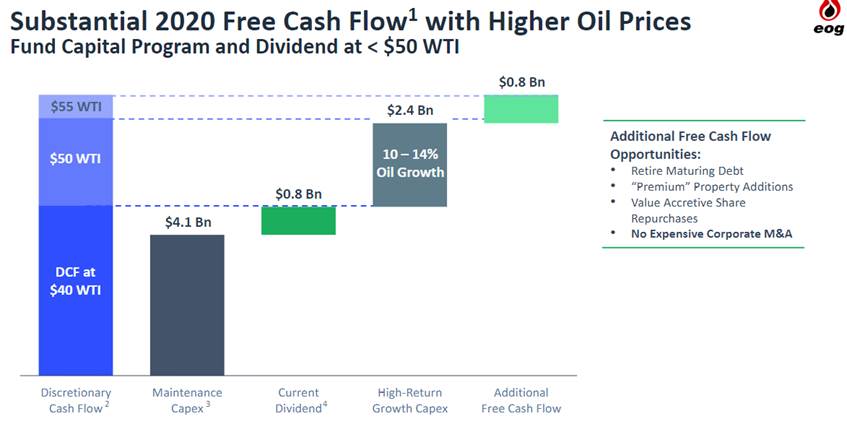

EOG released a 4Q19 earnings beat thanks to higher realized prices and lower costs. Production was up 11% y/y. Initial 2020 guidance shows oil production slightly below guidance (+10-14% growth is -2% to 0% below consensus) and capex slightly above consensus expectations. The company is increasing its dividend by 30% (~2.5% dividend yield). This year a greater portion of the capex will go towards infrastructure improvement rather than oil production growth – infrastructure is critical to lower well costs and thus increase returns. Environmental projects around emissions/water usage will help reduce costs as well. The management team decided on being more conservative in its capex plans as the oil prices have dropped a lot in 1Q so far. Additional free cash flow that would be generated if the WTI goes above $55/barrel would go towards retiring debt, acquisition of premium property for drilling, share repurchase, but no M&A. We updated our price target as we moved into 2020.

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

Tag: EOG

category: earnings

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109