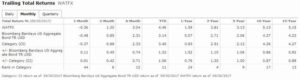

Western Asset Core Bond outperformed the Barclays Aggregate Index during the quarter, helped by high quality credit and an overweight to non-agency MBS. The team recently added to its agency MBS exposure to take advantage of improved valuations.

Market Overview:

– U.S. Treasury yield curve flattened during third quarter

– U.S. bond markets posted positive returns as spread sectors outperformed Treasuries

– Commerce Department reported that second quarter 2017 GDP was 3.1%

o Strongest GDP growth reading in two years

o Increase of growth reflected upturn in private investment, acceleration in personal consumption, deceleration in imports and increase in federal spending

– Labor market was generally solid during the quarter

o Unemployment rate fell to 4.2% by September, representing lowest level since 2001

– Manufacturing sector continued to expand and pace of accelerated as quarter progressed

o 11th month of consecutive expansion

– Fed kept rates on hold in range of 1.0-1.25% during the quarter

o Left open the possibility of another hike in December

o Committee will initiate balance sheet normalization in October

Performance Overview:

– During the quarter, the fund outperformed the Agg

– An overweight to investment grade corporate bonds was positive as spreads narrowed

o Strong performers included Wells Fargo, Bank of America, and Citigroup

– An overweight to non-agency MBS contributed to performance amid solid demand

– CMBS and ABS were modestly beneficial during the period

– Finally, duration positioning contributed to performance

– Underweight to agency MBS was a relative detractor

o Negative results from United Technologies and Anglo American Capital

– Team added to its agency MBS exposure, moving from an underweight to overweight

o Change made to take advantage of improved valuations

o We are more comfortable with this sector as the Fed’s balance sheet reduction

Market Outlook:

– U.S. economic recovery continues as unemployment is back to pre-crisis levels at 4.2%

– However, core inflation continues to remain stagnant

o Janet Yellen has declared much of the decline to be transitory due to one off factors such as wireless pricing

– The Fed’s models predict inflation based on core PCE

o This suggests the Fed needs to continue gradually increasing rates to more normal levels

– Fed admits that the shortfall of inflation is surprising given that there are not similar headwinds to previous years

o If 2% inflation is a target and not a ceiling, then perhaps the notion of raising rates needs to be questioned

– With global growth picking up EM and European countries, there should be few headwinds from abroad to impede U.S. growth

o The team believes spread products should continue to outperform government bonds

– Returns in high quality fixed income products should be expected to be modest

– Demand for income and yield provides the possibility of spreads tightening further

– The global economy is healing against a muted inflation backdrop that is unlikely to change soon

o Central Bank policy should remain benign

Performance Review: