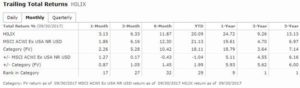

During the quarter, the Hartford International Value Fund outperformed its International Value Index and continues its track record of consistent relative performance. The team benefitted from bottom-up stock selection in Q3.

Market Overview:

– International equities rose during the quarter driven by expansion of global economic growth, supportive monetary policy, and low inflation

– Eurozone confidence reached a decade-high level during the month of September

o Came on the back of solid employment and manufacturing numbers, as well as re-acceleration in the service sector

– As global economy continued to gain momentum, central banks began to normalize long-standing loose monetary policy

– Angela Merkel was re-elected for a fourth term as German Chancellor

o Merkel and Macron now face task of deepening Eurozone integration

– MSCI EAFE Value Index rose 5.9% during the quarter

o Energy, materials, and consumer discretionary sectors rose the most

Performance Overview:

– HILIX outperformed the MSCI EAFE Value Index and its Lipper peer group average during the quarter

– Sector allocation a result of our bottom-up stock selection process was primary contributor to benchmark relative performance

o Positive performance from an underweight to health care and an overweight to materials offset overweight to technology

– Regionally, fund’s allocation to emerging markets was a relative detractor

– Security selection contributed to relative performance during the quarter

o Selection was strongest in industrials and consumer discretionary

o Top relative contributor during the period was Japan Steel Works

Market Outlook:

– Reminiscent of the rally value stocks had in the back half of 2016, cyclicals returned to favor during the period

o Cyclicals outperformed their more defensive counterparts

– Year to date strength in the IT sector extended through the third quarter

o As a result the team has been trimming tech names that reached price targets

– At the end of the quarter, our largest sector overweights were to consumer discretionary and information technology

o Largest underweights were to financials and real estate relative to benchmark

– Largest country overweight was to Japan while largest underweights were in Australia and Germany

Performance Review: