Sharing some thoughts on Disney given the stocks reaction to the coronavirus. The biggest impact to Disney would be to their Parks business and their Theatrical Distribution business assuming more parks close or park attendance just drops, along with attendance at theaters. I’m also including some commentary on their surprise CEO change, which I think has had a lesser impact on the stock.

Parks & Experiences:

· This business was expected to be a little under 30% of op income. About 90% of that is their US Parks and related resorts. Essentially Walt Disney World, Walt Disney Land, Epcot and the resorts that surround them. The segment also includes 4 Cruise ships, but this is a very small part of their business.

Theatrical Distribution:

· Theatrical distribution portion is ~42% of Studio segment or about 7% of total op income.

· Their Box office is spread geographically. So, to the extent that Coronavirus is popping up in certain areas, while subsiding in others this should mitigate the total impact.

· Additionally, they have the option to delay film releases. For instance, they have done this with Mulan in China.

· Disney+ is the exclusive landing spot for content. To the extent that this pushes subscribers to Disney+ because they missed a movie in the theaters, I would argue the lifetime value of a sub is likely worth much more than their take rate per visit at the box office. Obviously only a fraction of lost theater visits will convert as new subs. But the larger point is that they do have an offset. And an incremental subscriber is all margin for them. If they last 1 yr. it’s ~$70. They have 40-50% take rate at the box office.

Valuation:

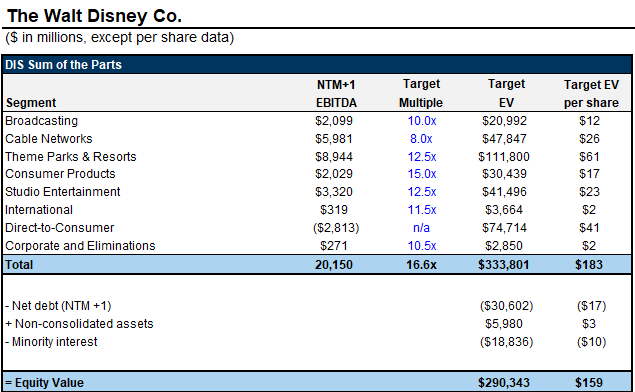

· For perspective, below is a sum-of-the-parts analysis by Goldman. This analysis suggests, Disney’s Parks and Theatrical Distribution are worth roughly 39% of their business (assuming the value of Theatrical Distribution is in proportion to their revenue contribution to Studio).

· You could argue that the recent drop in price (~21%) suggests that more than HALF of the value of these businesses permanently disappeared. With no offsetting benefit to any other part of their business (i.e. DTC).

· To the extent that consumer behavior returns to normal after the coronavirus subsides…however long that takes…the out year numbers that are in expectations should be intact. As the valuation multiple on those numbers returns, so should the stock price.

CEO change:

· Iger is staying on until the end of his contract, through the end of 2021. He is being succeeded as CEO, effective immediately, by Bob Chapek.

· Iger will continue to be focused on a key part of the business – content – and continue to be central to Disney’s effort to shift their content model to DTC. In fact, he will be more focused on this than he would have been were he to stay in the CEO role. The skeptical take on this would be – does this mean there’s an issue with content? Maybe with the Fox integration? Given excellent subscriber numbers and the potential benefit/upside of Iger spending all his time on content, I don’t think there is a reason to be overly negative about this change.

· Impression of the new Bob by investors seem to be quite positive.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$DIS.US

[category equity research]

[tag DIS]