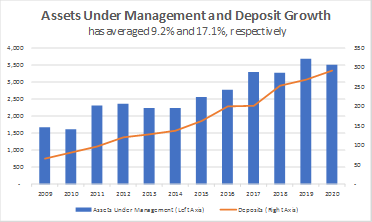

Last week, Schwab hosted their Spring Update to discuss reported Q4 earnings of $.62. Despite interest rate headwinds, asset growth was solid with healthy core asset growth of $73b (+7%). Deposits grew sharply +$58.7b up 21% as investors sold stocks and increased cash. Deposit levels grew mostly towards the end of the quarter and will support earnings moving forward. Valuation remains attractive.

Despite lower interest rates, we remain optimistic that SCHW will grow AUM significantly this year, leveraging its platform to drive ESP growth.

Current Price: $ 35.4 Price Target: $43

Position Size: 2% Performance since initiation on 6/24/19: -8.5%

Q4 Highlights:

· Total client assets fell to $3.5T, down from $4.0t in Q4 due to market action. Core asset growth should remain healthy into 2020 with two acquisitions – USAA Investment Management ($90b in AUM) and TD Ameritrade ($1.2t in AUM). These two acquisition represent a 37% increase in AUM. Combined with core new growth of ~6% shows the potential growth in earnings power for SCHW as they lever their platform.

- Deposit growth

- Deposits shot up 21% ($58.7b) during the quarter. SCHW temporarily invested these new deposits at the Fed for a meager 9bips in yield. On the call SCHW said they are investing these funds at a rate of $30b per month at a rate around 1.50%.

- Investing $58b at 1.5% for the whole quarter would lead to a +30% increase in revenue for the quarter, so these interest earning assets are significant. Deposits are sure to move higher given continued market volatility.

- Deposits shot up 21% ($58.7b) during the quarter. SCHW temporarily invested these new deposits at the Fed for a meager 9bips in yield. On the call SCHW said they are investing these funds at a rate of $30b per month at a rate around 1.50%.

- Net interest margin

- Net Interest Margin (NIM) was 2.14% decreased only -20bips YoY given lower rates.

- Looking back NIM bottomed in 2013 at 1.56%, so NIM will continue to fall.

- SCHW can save some margin by reducing deposit rates paid to zero from 10bips now.

- While there are a lot of moving parts, if NIM falls to prior lows of 1.56%, deposits would need to rise by $120b to offset the income loss. While completely offsetting that revenue drag is not likely, the +58.7b jump in deposits in Q1 shows the power of rising deposits.

- Net Interest Margin (NIM) was 2.14% decreased only -20bips YoY given lower rates.

- Advice and Funds

- Schwab fee based advice solutions assets grew $263b up 12% YoY.

- Schwab revenue from funds and ETFs rose $452m up 9.1%

- Schwab fee based advice solutions assets grew $263b up 12% YoY.

- Profitability – industry leader

- Profitability fell due to M&A costs – ROE 14% and 40% pre-tax profit margin

- Expenses up only 8%, of which 4% are due to mergers

- Profitability fell due to M&A costs – ROE 14% and 40% pre-tax profit margin

- Capital allocation

- Schwab will look to issue a preferred stock issue as growth in balance sheet and acquisitions will require more capital. Share buybacks are on hold.

- Dividend yield of 1.87%

- Valuation is attractive at 18x earnings. Target price set at 21x.

- Schwab will look to issue a preferred stock issue as growth in balance sheet and acquisitions will require more capital. Share buybacks are on hold.

Schwab Thesis:

· Expect Schwab’s vertically integrated business model to drive AUM growth. Schwab has averaged 6% organic core net new asset growth as retail clients and advisors are attracted to Schwab’s low cost trading and custody services.

· Conservative, well-managed firm who is a leader in online trading and focused on leveraging platform.

· Schwab will experience material AUM growth with USAA and TD Ameritrade mergers. Expect SCHW to reduce costs and leverage platform.

Please let me know if you have any questions.

Thanks,

John

($SCHW.US)

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109