Key takeaways:

· Sales growth higher than expected in Q1 due to pantry loading – Q2 sales to be slightly negative

· Acquisition of Rockstar Energy Beverages closed, and entered exclusive distribution agreement of Bang Energy drinks – progressing on its efforts to capitalize on the rising demand for functional/energy drinks (high growth/high margins category)

· 2020 guidance withdrawn given COVID-19 uncertainties

· Dividends and share repurchases remain

Current price: $136 Price target: $153

Position size: 2.48% 1-year performance: +6%

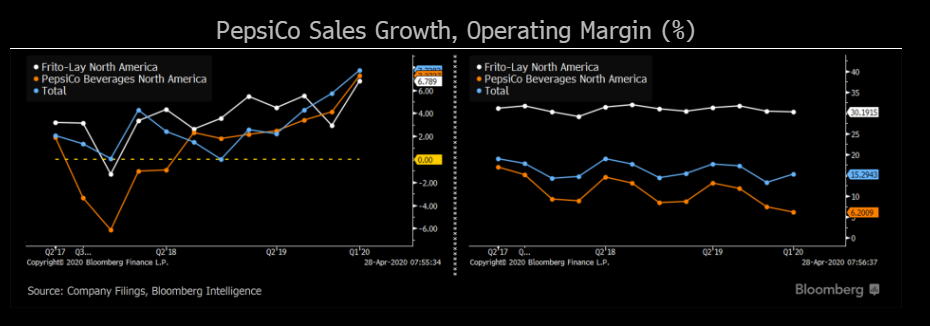

Pepsi released their 1Q2020 earnings results this morning: +7.9% organic sales was above consensus of 3% (thanks to pantry loading) and EPS of $1.07 was roughly in line with consensus of $1.03. Profits were slightly better as well. Guidance for the year was withdrawn due to the virus impact being hard to measure. However the management team is expecting a low single digits decline in sales in 2Q: slower EM channels and weakness in immediate consumption channels (convenience stores/bars). The management team continues to expect large-format/e-commerce channels to benefit from recent trends, with a gradual improvement in convenience stores as people return to work. Regarding costs, labor, logistics and service costs are higher to meet consumer needs. To reduce the impact of these costs, the company is reducing discretionary and non-essential marketing expenses. As for liquidity, PEP has ample flexibility and plans to return cash to shareholder through dividends and continue share repurchases. Regarding its energy drinks strategy, PEP plans to accelerate Rockstar’s market share gains, improve Bang’s distribution and unlock potential at Mountain Dew that was previously limited by the Rockstar agreement.

Segment details:

Thesis on Pepsi:

- Global growth opportunity with about 40% of profits coming from outside the US. CSD is only 25% of sales (and Pepsi brand only 12%)

- Strong market share in high growth emerging markets where there is low penetration and rising per capita consumption

- Resilient snack business provides pricing power and visibility to future cash flows (more than half of sales are from snacks not beverages). CSD is only 25% of sales (and Pepsi brand only 12%)

- Several Great brands driving global growth: Frito Lay, Quaker, Gatorade

- Strong balance sheet and cash flows support a solid dividend yield and share buyback program

Tag: PEP

category: earnings

$PEP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109