Key Takeaways:

· Q1 saw large end-markets decline globally, with Sensata doing better thanks to content growth

· Q2 to be more challenging (already priced in the stock)

· China pointing to a recovery

· Could see people using more individual cars rather than public transportation due to COVID-19 change in habits

Current Price: $38 Price Target: $53 (NEW to reflect 2020 results)

Position Size: 1.83% 1-year Performance: -26%

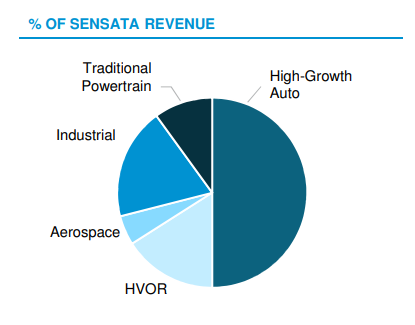

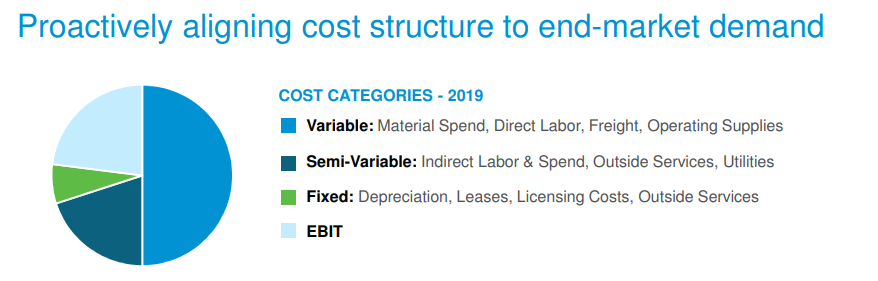

Sensata released 1Q20 results, with organic sales declining ~11%, as end-markets declined 18%. In Q1, light vehicle production declined 20% globally, and IHS predicts a 47% decline in Q2 (with Europe expected to decline 61%, China expected to decline 9%, and North America expected to decline 70%. Also, according to IHS, the full-year 2020 global automotive production is now expected to decline 22%). In Q1, industrial markets declined 15% globally, and the decline is expected to continue in Q2. Sensata’s profits were impacted by lower revenue, elevated costs to protect employees and operational restrictions, limiting the alignment of costs to declining end-markets (see chart below for cost structure of the company). A few good news came during the call: 1) the nice improvement of the balance sheet quality, now 2.9x levered; 2) China is returning to normal level of production internally, although exports are still challenged. Sensata is also monitoring a potential trend post-COVID where the consumer could be using less public transportation and prioritizing again individual means of transportation. So in conclusion, while Q2 will be a challenging quarter, we think we could see a recovery in end-markets later in the year, as China is pointing towards. We updated our price target to reflect the lower sales and profit levels in 2020.

Segments review:

· Automotive organic sales decline of -10.4%: Sensata outgrew this sector by 600bps, thanks to inventory build adding 310bps of growth in Q1 (pulled forward some Q2 demand). Q2 should be a lot worse as OEM plants remain closed (~25M loss in revenue per week for ST, and expecting 4-5 weeks shut-down)

· HVOR organic revenue decline was -10.7% y/y: Sensata outgrew this sector by 930bps thanks to content growth in China (China VI regulations implementation)

· Industrial: organic decline was -10.4%: Sensata outgrew this sector by 430bps. China revenue was down 33%

· Aerospace declined 2%, outgrowing end markets decline of 6% thanks to content growth

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109