On 5/2, Berkshire Hathaway reported Q1 earnings and held its annual shareholder meeting. Key takeaways are as follows:

· Berkshire is a collection of best-in-class businesses with an extremely conservative financial position – $137b in cash represents over $55 per share.

· No major capital allocation changes. Through this downturn, Berkshire has not made any meaningful acquisitions despite the large cash balance and the economic slowdown. Their largest actions was to completely sell all their airline holdings.

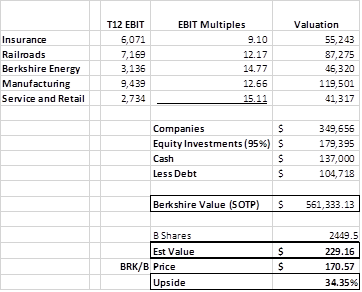

· BRK/B is selling at a 34% discount. After some underperformance relative to the market, Berkshire is selling at a 34% discount to intrinsic value and below the value at which Buffett has stated he would buy shares.

Current Price: $170 Price Target: $225

Position Size: 2.7% TTM Performance: -16%

Highlights from the quarter:

· Operating earnings fell -2.6% due to economic weakness from the coronavirus.

· Operating profits from Insurance operations were strong rising 7.6% after taking a $230m charge for Covid-19 coverage which is a 8.4 points increase on the combined ratio.

· Burlington Northern operating profit -5% QoQ, manufacturing and retail hit hardest -7.4% QoQ

· Quarterly losses in the equity portfolio were $54.5b

Highlights from the investor conference held online:

· As usual, Buffett stated his confidence in the long-term growth prospects for the US economy. Never bet against America!

· Completely sold airline stocks – $6.4b worth. He said he made a mistake buying them.

· No big changes in capital allocation. They have not seen any deals worth taking. Large cash position and inactivity is similar to 2007 period, when press was saying Buffett had lost his touch. Last big deal was in 2016 when they bought Precision Castparts for $37b.

Valuation: Berkshire is selling at a 34% discount to intrinsic value using sum of the parts. Their cash of $137b represents $55 per share for B shares.

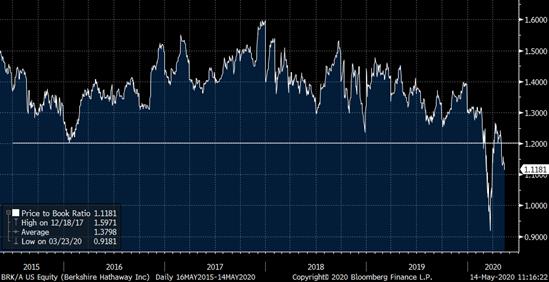

Currently, BRK/b is selling at 1.1x book value. Buffett has stated that buying shares below 1.2x (shown as horizontal line in below chart) would be accretive to shareholders. During the annual meeting, he did not state that share buybacks would be a big use of cash. This P/B level has not been seen since 2012.

Berkshire remains a core holding, is currently undervalued and is defensively positioned to take advantage of opportunities as they arise.

Please let me know if you have any questions.

Thanks,

John

($brk/b.us)

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109