Hi All – We have put together some big picture data points to help put in perspective the market recovery. This is not a call on where the market is headed, but hopefully these points can be helpful in framing discussions with clients. We’ve used revenue data for a couple reasons. First, profit numbers can be “noisier” with write-downs, mark to market accounting, pension contributions etc. and profits may go negative making % changes not meaningful especially when looking at aggregated data. Second, in thinking about whether consensus reflects a “V” shaped recovery, revenue seems to make the most sense to look at because it represents demand, whereas profits represent differences in operating leverage across companies, cost cutting decisions which vary by company, cuts to capex, etc.

1. Narrow breadth is a big factor driving the market. Growth is being disproportionately driven by a small number of companies.

a. The top 42 weighted companies in the S&P account for ~50% of the index.

b. Based on consensus, the S&P is expected to see almost 9% weighted avg. revenue growth in 2021 vs 2019 baseline.

c. Those top 42 weighted companies are expected to contribute ~80% of that 9% weighted avg. revenue growth in 2021 vs 2019 baseline. So they are expected to contribute 7pts of growth while the rest (or >90% of constituents) collectively contribute 2pts.

d. Since Covid hit in the US on Feb 19, the S&P is down 7.4%. The 11 top contributors to the S&P since then make up 20% of the S&P and contributed almost 3% to performance.

2. Does consensus reflect a “V” shaped recovery? Not for many of the hardest hit stocks…which is a lot of companies, but a small part of the S&P.

a. Not recovered in 2021: ~44% of constituents (~24% of the weight in the S&P) are expected to have revenue in 2021 that is still below 2019 baseline. These companies represented a 6.5% drag on S&P performance since Covid hit. The top 11 contributors offset >40% of this.

b. Hardest hit: ~32% of S&P constituents (17% of the weight) are expected to have revenue in 2021 that is more than 5% below 2019.

c. Multiyear recovery: ~29% of S&P constituents (15% of the weight) are expected to report revenue in 2022 that is still below 2019.

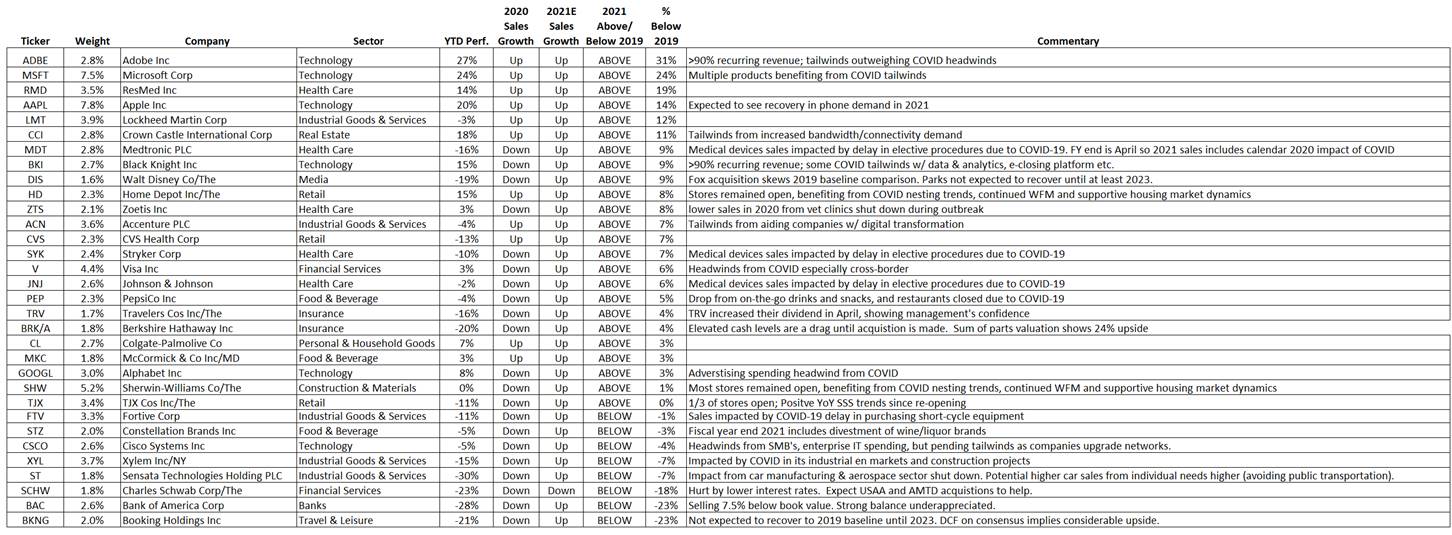

3. Our portfolio is well positioned.

a. Not recovered in 2021: only ~22% of our names (18% of the weight). Excludes STZ b/c of divestment.

b. Hardest hit: ~16% of our names (11% of the weight) are expected to have 2021 revenue that is more than 5% below 2019 baseline.

c. Multiyear recovery: ~6% of the weight and 3 names (BAC, SCHW, BKNG). For BKNG a recovery to baseline is not expected until 2023. However, using consensus numbers for a DCF valuation implies meaningful upside. That suggests the stock is discounting an even worse outcome.

d. Proportionately, our names have seen less of a hit and are expected to recover quicker and are more profitable, higher ROIC and trading at a higher FCF yield than the S&P.

Conclusion: Based on consensus numbers the bounce in the market seems to be driven more by narrow breath than a broad assumption of a “V” shaped recovery. Many of the hardest hit S&P companies are expected to see an impact beyond 2021. The caveat to that is that drawing a connection between consensus expectations and market action is limited by the fact that the market is not just driven by street expectations (it’s only a piece) – this is generally true but especially so now when there is so much uncertainty related to Covid and its continued impact on the economy. Additionally, it’s not possible to delineate on an aggregate level to what extent consensus numbers indicate continued impact of the virus or a recession or both, because both circumstances tend to impact similar industries like auto, retail, travel and restaurants. Finally, many of the names benefiting from Covid tailwinds make up a large percentage of the S&P which overwhelms the impact of the hardest hit companies.

Thanks,

The Research Team

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109