Key takeaways:

Current Price: $147 Price Target: $175

Position size: 2.52% 1-Year Performance: +12%

· Guidance for the year raised (a reminder that it was lowered last quarter) as its medical devices segment bounded back quicker than expected:

o Medical devices results -33% vs guidance of -50%

o Operational sales growth of -0.8% to +1% (from -3.0% to +0.5% last Q but overall still down from its initial guidance of +5.0-6.0%)

o EPS raised to $7.75-$7.95 (from $7.50-$7.90 last quarter but still down from initial guidance of $8.95-$9.10).

· Pharma segment showed steady performance with ~4% organic growth

· Consumer segment down (-3.6% organic sales) due to competition in Pepcid, lower beauty and women’s health sales (Covid impact)

· Improving office visits trends within the quarter

· Delay in its robotic surgery program, as it combines its recent Auris business acquisition with its Verb prototype, and is changing its FDA filing

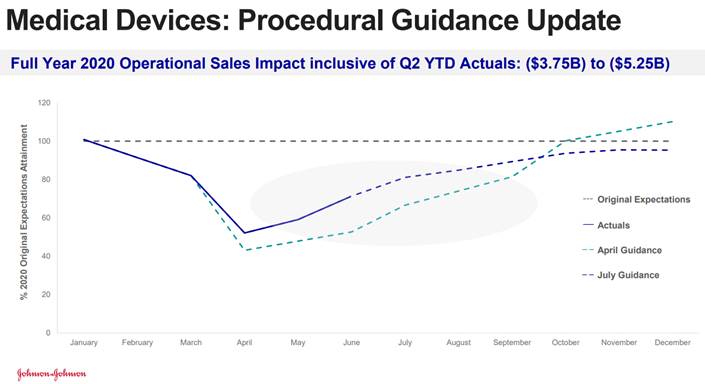

Overall JNJ posted sales higher than expected as its medical devices segment recovered faster than expected. Organic sales overall were down 9% while earnings dropped 35% (due to medical devices segment earnings decline). But to tamper this good medical devices rebound news, JNJ now expects Q4 recovery to be lower than previously thought in April, with sales down 15% to flat in Q4 vs. 0% to +10% previously guided in April (see chart below showing the evolution of guidance in its medical devices sales). The office visits improved during the quarter, recovering from a 70% drop to -15% decline in late June. JNJ said its vaccine is on track for a potential approval in early 2021 (human trials starting on July 22nd) and capacity of 1B dose in 2021.

Overall we think the diversified business model of JNJ will help the company navigate today’s environment, while the management team reiterate its desire to find a vaccine for COVID-19 on a non-profit basis (positive company image/government discussion on other drug pricing maybe but no impact to bottom line).

Thesis on JNJ:

- High quality company with consistent 20% ROE, attractive FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

- Strong balance sheet that offers opportunities for M&A.

[category Equity Earnings]

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109