Key Takeaways:

· Q2 organic sales -34% but still outperforming its end-markets (down 40%) and improving intra-quarter

· Cash flow remains positive thanks to cost reductions, capex and working capital management

· Liquidity is sufficient and we see no risks to trigger any debt covenants

· M&A: acquired PRECO Electronics a leader in radar sensing solutions, as the company continues its push into autonomous vehicle/electrification trends

· Q3 trend expected to see continued ramping up in auto production, although guidance is more conservative than industry forecast due to COVID-19 spikes in the US

Current Price: $39.8 Price Target: $53

Position Size: 1.88% 1-year Performance: -26%

Sensata released 2Q20 results, with organic sales declining 34%, as end-markets declined 40%. The company was able to reduce costs as mentioned last quarter, with a 10% reduction in semi-variable costs (indirect labor, outside services and utilities). While this is good news, operating margins still decreased (2Q20 margin at 13% vs 23% last year). The underutilization of manufacturing capacity and increased safety costs related to COVID impacted the overall company profitability.

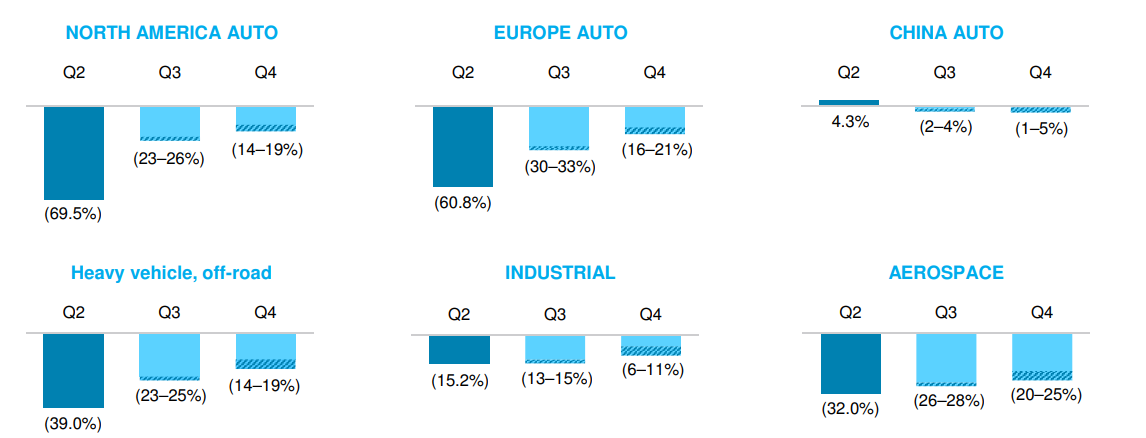

The company continues to win new businesses in electric vehicles, increasing its average content above the internal combustion cars. The management team remains conservative in its Q3 and Q4 outlook (vs. IHS, the industry forecaster). While we should expect an improvement every quarter going forward, the growth rate remains negative (see chart below). What keeps us invested in the stock is the company’s ability to innovate and win new businesses while continuing to invest in secular drivers, helping Sensata outgrow its end markets by 400-600bps in auto and 600-800 in HVOR.

Segments review:

· Automotive organic sales decline of 42%: Sensata outgrew this sector by 890bps, thanks to emissions, electrification and safety new product launches

· HVOR organic revenue decline was -31.5% y/y: Sensata outgrew this sector by 750bps thanks to new regulations in China

· Industrial & other: organic decline was -14.6%: medical devices growth help this sector

· Aerospace declined 39.4%, and saw a deterioration in its aftermarket business

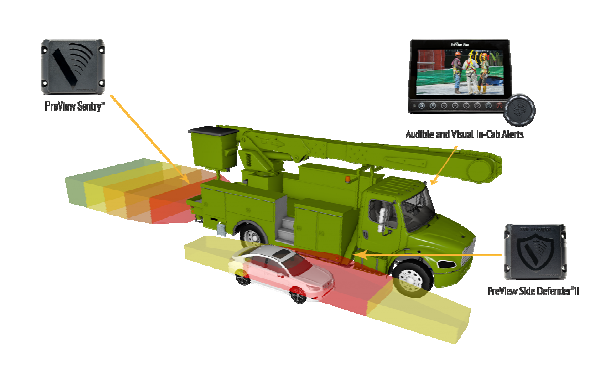

PRECO electronics: design, engineer and manufacture collision mitigation technology for heavy-duty equipment.

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109