REEIX Commentary – Q2 2020

Thesis

REEIX is driven through both top-down and bottom-up fundamental research that provides diversification within our full EM allocation. The fund looks for high quality companies across all market caps that have strong ESG scores. We like REEIX because of the consistent and repeatable process that allows the team to take advantage of companies with sustainable growth across all the Emerging Market (EM) landscape.

[more]

Overview

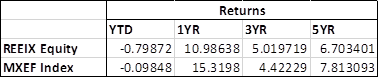

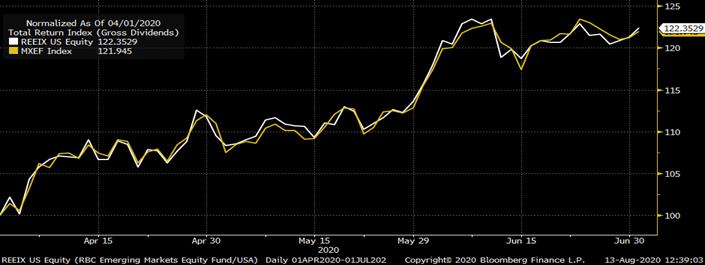

In the second quarter of 2020, REEIX outperformed the benchmark (MSCI Emerging Markets Index) by 22bps. China and Taiwan helped provide a boost to returns, while Brazil and India significantly underperformed. Strong stock selection within South Africa and India contributed to returns, yet a lack of exposure to China detracted from positive performance.

Q2 2020 Summary

– REEIX returned 18.30%, while the MSCI Emerging Markets Index returned 18.08%

– Contributors

o Largest contributor was NCSoft, a South Korean gaming company

– Detractors

o No exposure to Alibaba, a Chinese internet-service company

–  Market volatility has allowed the fund managers to find relatively attractive stocks to allocate to

Market volatility has allowed the fund managers to find relatively attractive stocks to allocate to

Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s historically strong returns and understanding of Emerging Markets on both a macro and micro level

– In the medium to long-term, REEIX expects four factors to play a key role in EM equities

o US dollar

o Economic growth differentials between EM and International Developed Markets

o Earnings growth

o Valuations

– The team will continue to focus on high quality companies with strong balance sheets and cash flows

– 5 focused themes

o Domestic consumption

o Health and wellness

o Digitalization

o Financialization

o Infrastructure

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109