AFVZX Commentary – Q2 2020

Thesis

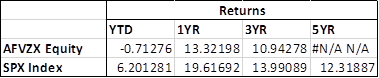

AFVZX is our only active manager in the large cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding roughly 50 companies. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[more]

Overview

In the second quarter of 2020, AFVZX underperformed the benchmark (S&P 500 Index) by 41bps. Six of the eleven sectors outperformed the benchmark, while the rest underperformed. Underweighting of the largest market cap names was the main reason for underperformance, as relatively smaller capped stocks lacked in performance. The fund’s value tilt also detracted from returns.

Q2 2020 Summary

– AFVZX returned 20.13%, while the S&P 500 Index returned 20.54%

– Top contributors

o Consumer Discretionary – APTV, LOW, DRI were main drivers

o Financials – AMP and COF were main drivers

o Industrials – All six holdings beat the XLI sector benchmark

– Top detractors

o Information Technology – FISV, HPQ performed worst

o REITs – HST, the largest lodging REIT in the U.S., has large exposure to business and leisure travel

Optimistic Outlook

– We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

– The fund managers believe there is good reason for the market rebound

o U.S. Fed and Government involvement

o Quicker reopening than expected, which has gone well so far

o Hopeful and encouraging vaccine news

– The fund managers see the current market as rich in valuation, which could increase negative surprises; yet, equity risk premiums are still high

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109