On 10/13, Bank of America (BAC) reported core Q3 EPS of $.48 with positives of sharp decrease in provisions for bad loans and negatives of weak net interest income growth. We believe BAC is managing the pandemic recession well, has a strong balance sheet, is building excess capital and has strong earnings power.

Current Price: $24.2 Price Target: $30

Position Size: 2.26% Trailing 12-month Performance: -17.3%

Q3 Highlights:

- Strong credit quality with loan provisions falling to $1.4b from $5.1b

- Good news! The loan loss provisions were below street expectations and close to the normal quarterly run rate. Considering that these provisions are forward looking, it bodes well for the state of the economy and health of the banking system.

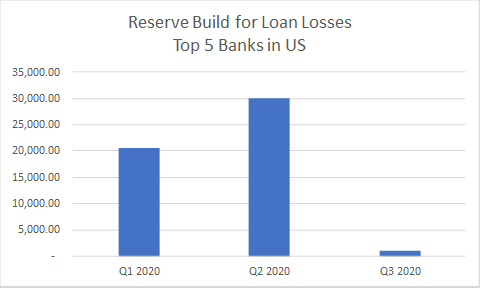

- US banks remain healthy. Reserve build for the Top 5 banks in the US dropped sharply close to the normal run rate of loan provisions:

- These provisions are NOT Comparable to those taken during the Great Recession. From Q4 2007 to Q4 2011, the top five banks increased provisions by $318b! More than 6x the provisions taken since the coronavirus pandemic started.

- BAC’s outlook for credit is positive. Consumer spending by their customers in October is about 10% above levels from last year. Consumer deferrals balances are down from $1.7b to $0.1b in September

- Net Interest income decreased to $10.24b from $12.34b a year ago as interest rates fell

- Net interest margin fell to 1.72% which they believe is the bottom

- Expect NIM to trend up as increased deposits are invested and balance sheet growth, though they noted reinvestment rates remain a headwind.

- NIM will remain depressed until we see a sustained economic recovery. At that point, banks will be among the industries most levered to benefit from the rebound.

- Strong balance sheet

- Nonperforming loans are lowest among peers

- Fed’s stress test has consistently shown BAC losses to be lower than peers

- Strong capital ratios: CET1 ratio of 11.4% which is 1.9% above required minimum

- Attractive valuation

- BAC is selling at a discount to book value! at 0.86x Book value and 11.8x P/E

- BAC has strong earnings power – generates over $5b a quarter in earnings

- BAC continues to build capital as share buybacks and dividend increases are restricted. They have $35b in excess capital which equates to 6% of shares outstanding.

BAC Thesis:

- BAC has dramatically improved their Consumer Banking unit which has driven earning’s growth. Loss metrics are best among peers.

- Despite current recession, BAC has strong balance sheet and earnings power

- Their stronger capital position should lead to increased dividends and buybacks

Please let me know if you have questions.

Thanks,

John

[category Equity Earnings]

[tag BAC]

$BAC.US