Key takeaways:

- Investors most likely awaiting election results to see impact on defense budget, recent pullback suggest market seeing a Democrat winning the election (and possible decline in Defense Budget) – a Democratic President does not necessarily mean a decline in the Defense Budget! A Biden wins does not mean we need to sell Defense names.

- Preliminary trends for 2021 look good, but below consensus (+3% sales growth). LMT is always cautious in its initial guidance, and raises it throughout the year. Book-to-bill remains above 1x (1.2X), which is a sign of future sales. Margins should tick higher slightly

- 3Q20 results were good, sales growth of +9% was driven by all segments.

- Share repurchase program was increased by $1.3B, with $3B remaining for future repurchase.

- Leverage remains very low at 0.9X net debt/EBITDA for a company with great cash generation potential. We should expect M&A action near term.

Current Price: $375 Price Target: $469

Position Size: 3.51% 1-year Performance: -1%

Lockheed released its 3Q20 earnings results earlier this week. Sales were up 9% y/y and EPS +10%. Sales per segment were as follow:

- Aeronautic +8% (F-35 and classified contracts),

- Missiles and Fire Control +14% (higher tactical and strike missile programs),

- Rotary and Mission Systems +8% (higher Sikorsky helicopter sales)

- Space Systems +6% (government satellite programs, strategic & missile defense programs)

Because of the continued strong results, the company raised its 2020 outlook, higher than the top end of its July’s guidance, for its sales, operating profit and EPS lines. Backlog was up 4.4%, driven by all segments (mostly Aeronautics, which includes their F-35 program). In 2021, Lockheed intends to repurchase over $1B shares. Its pension funding requirement amounts to $1B.

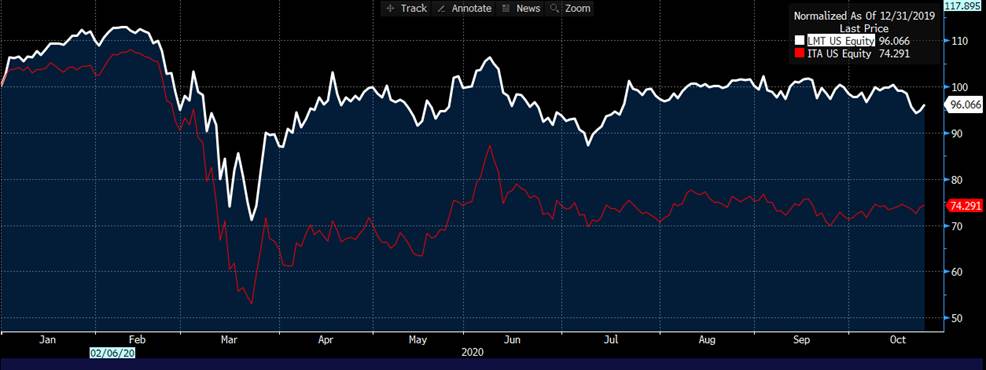

Overall, LMT continues to deliver strong shareholders returns. It has outperformed peers in the last 3 years and YTD.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109