HILIX Commentary – Q3 2020

Thesis

Serving as a satellite holding, HILIX is a value style fund that takes advantage names that have underperformed recently and are cheaply priced. The team generates alpha by finding companies with strong fundamentals that are overlooked during times of low consensus expectations. We like that HILIX takes advantage of extremes and gains exposure to less efficient market caps by having more holdings and moderate active bets.

[more]

Overview

In the third quarter of 2020, HILIX underperformed the benchmark (MSCI EFEA Index) by 1.99% due mainly to the fund’s allocation to Energy and Financials. Heavy overweight to Energy, a sector that had poor performance during the quarter, heavily detracted from HILIX’s overall returns. Financials also underperformed and the fund’s overweight to this sector detracted from returns. Strong stock selection within Materials and Industrials contributed to returns. Additionally, selection in Developed Europe & Middle East ex UK and Japan contributed to performance, yet was offset by weak selection in Pacific Developed ex Japan.

Q3 2020 Summary

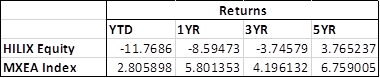

- HILIX returned 2.81%, while the MSCI EAFE Index returned 4.80%

- Top issuer contributors

- AP Moeller-Maersk

- Shimamura

- Top issuer detractors

- Not owning Siemens

- Not owning NTT DOCOMO

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s value and bottom-up, fundamental approach

- YTD the fund has taken a heavy loss due to poor performance by the Value factor in International Developed markets

- The fund continues to focus on low valued companies that are pro-cyclical

- Energy, Financials – overweight

- Consumer Staples, Healthcare – underweight

- The fund managers believe with such extreme valuations on the growth side there will likely be a bounce-back in value stocks as the world emerges from the recession and a COVID vaccine becomes more attainable

- Central banks and regulators are seeing banks as safer hands to deal with when it comes to transmission of monetary policy to privacy to cyber-crime to digital currencies – could possibility lead to high growth in Banking industry

- Energy selloff has been a bit of an overstatement, as fossil fuels will play a large role for years to come

- Value has been underperforming for some time, yet historically it has proven to outperform

- HILIX remains comfortable that their holdings will be able to withstand this market turbulence

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109