LISIX Commentary – Q3 2020

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

[more]

Overview

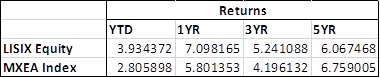

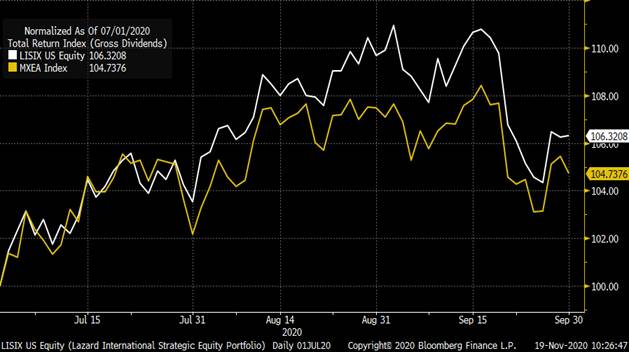

In the third quarter of 2020, LISIX outperformed the benchmark (MSCI EFEA Index) by 1.91% due to the growth factor’s strong performance. Strong stock selection helped drive outperformance, especially in Continental Europe, the UK, and Japan. Sector-wise, selection in Communication Services, Financials, Industrials, and Information Technology contributed to returns. Selection in Consumer Staples, on the other hand, detracted from returns, as did holding cash.

Q3 2020 Summary

- LISIX returned 6.71%, while the MSCI EAFE Index returned 4.80%

- Contributors

- Makita and Nintendo – Japan

- Sampo and ABB – Continental Europe and UK

- Detractors

- Kao, Tesco, and Suncor – Consumer Staples

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s strong stock selection, ability to find well valued companies, and expertise in various market caps, geographies, and sectors

- Historically, value has begun to outperform when valuation is this cheap compared growth stocks and the global economy begins to accelerate

- With economies continuing to reopen, a potential COVID vaccine in the horizon, and government policy helping provide liquidity and demand, a long recovery could end up supporting value stocks

- Encouraged by developments in Europe, yet remain underweight in Japan

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109