Disney is up after holding an investor mtg yesterday after the close. The meeting was focused on their streaming services and they released updated long-term targets that were well ahead of expectations. Some key takeaways…

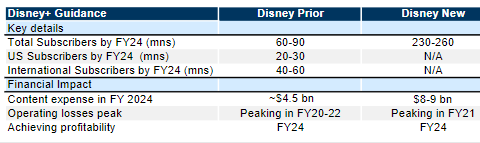

- As of Dec 2, Disney+ now has 87m subs (up from 74m at the end of the quarter they just reported) after only 1 year. Their original guidance when Disney+ was announced was for 60-90m subs by 2024.

- They now expect to achieve 230-260m Disney+ subs by 2024. This is well ahead of investor expectations that were closer to 165m. Netflix currently has <200m subs.

- They plan to increase prices in the US and Europe by $1.

- They’re increasing content production plans. Now expect over 100 original titles per year – including 10 Star Wars series, 10 Marvel series, 15 Pixar series and 15 Pixar feature films. This will result in higher content costs.

- Maintained their outlook for Disney+ to achieve profitability in F2024 given price increase and higher content costs.

- Released details on Star outside of the US.

- They plan to continue releasing franchise films (e.g. Marvel) into theaters.

- They won’t move ESPN away from linear distribution as quickly as their other content.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$DIS.US

[tag DIS]

[category equity research]