Key takeaways:

Current Price: $333 Price Target: $469

Position Size: 2.80% 1-year Performance: -23%

Lockheed released its 4Q20 earnings results and 2021 forecast yesterday.

- Revenue growth of 7% and segment operating margin +14% (+70bps expansion)

- Backlog still solid at $147B but moderated in growth (+2% y/y but down 2% q/q)

- Book to bill continues to decrease moderately which is something to keep an eye on as a predictor of future growth.

- But, since the company pre-funded a portion of its pension in 4Q20, it should help cash flow in the out years with less funding required. That resulted in 2022 and 2023 cash flow guidance to increase by $500M

- FCF implied guidance for 2021 is $6.6B with flat capex

- Slight increase in top line growth guidance: revenue and segment profit margins expected to grow between 3-5% y/y

Sales per segment were as follow:

- Aeronautic +5.2% (higher volume in F-16 and F-35),

- Missiles and Fire Control +3.5% (higher volume in Patriot and THAAD programs),

- Rotary and Mission Systems +8.3% (higher volume at Sikorsky helicopter programs)

- Space Systems +14.1% (higher volume on Next Gen OPIR and hypersonic development)

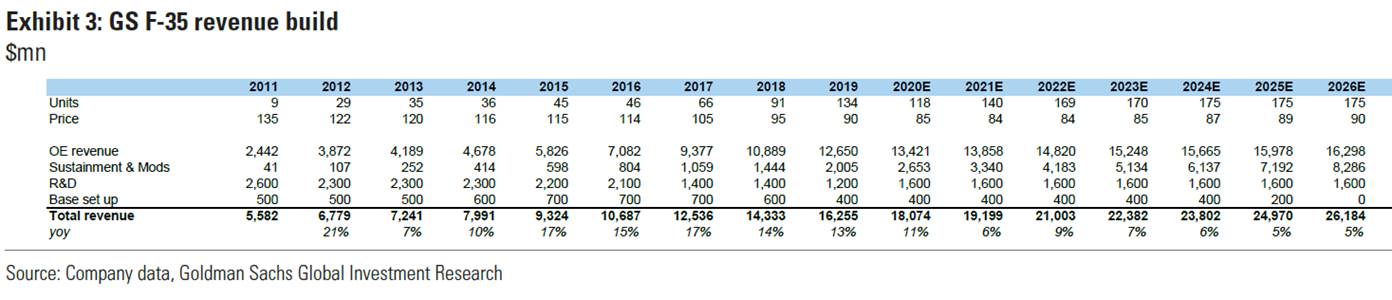

Here’s Goldman Sachs forecast on the F-35 revenue.

Overall this was a good quarter, but the focus remains on the Department of Defense budget, even though LMT has a pretty consistent and growing revenue stream coming from solid programs. We are not changing our price target or position size at this time.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109