Current price: $208 Target price: $226

Position size: 3.7% TTM Performance: 2%

Key takeaways:

- Beat estimates – Beat driven by solid top-line results and lower than expected op expenses and client incentives.

- Sequential volume improvement – with very strong debit and e-commerce spending globally, partially offset by weaker credit and in-store spending.

- Cross-border still a headwind but improving – improvement here is key as this is their biggest Covid headwind driven by travel restrictions.

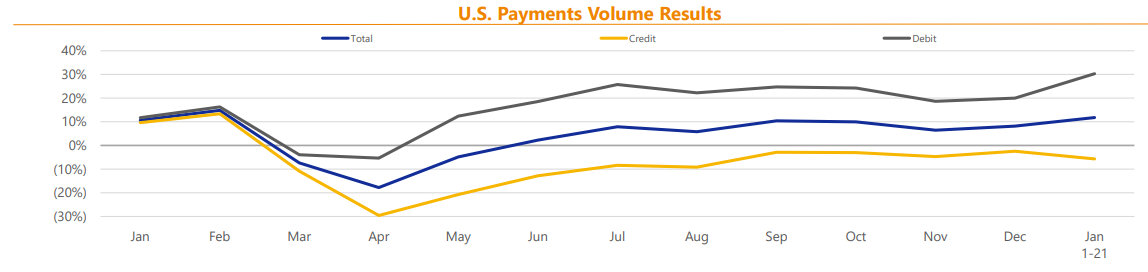

- CFO Vasant Pabhu said, “As we approach the first anniversary of the pandemic, where do we stand across our key business drivers relative to where we might have been had the pandemic never happened? Global payments volume is four points to five points short of where we might have been. Debit has outperformed helped by accelerated cash displacement and credit is still a drag. In the US, we are actually back to our pre-pandemic growth trajectory, with debit significantly ahead offsetting credit underperformance.”

Additional Highlights:

- Revenues were down 6% YoY driven by cross-border headwinds (down 21% YoY or -33% YoY excluding intra-Europe), but partially offset by volume growth. Operating expenses were down 10%, leading to margin improvement (lower advertising, administrative, and personnel costs).

- While cross-border spending did improve for the quarter, it remains depressed, led by travel spending, as the majority of borders remain closed.

- Cross border spending drives International transaction revenues which are >25% of total net revenues. As such, the steep drop is offsetting growth in service revs and data processing revs. As travel restrictions lift with the vaccine rollout, Visa will see a recovery in this meaningful piece of revenue.

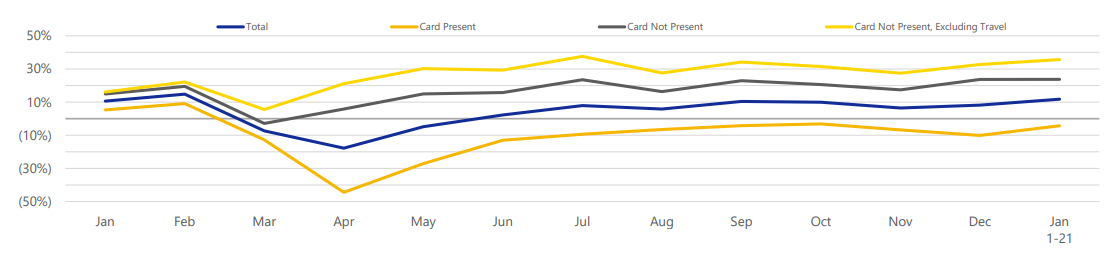

- Within the US, Total volumes are up slightly YoY driven by growth in debit while credit has lagged. Stimulus checks helping with this. Card present transaction are down YoY, while card not present, ex-travel is up as consumers shift spending online w/ lack of travel spending benefiting other categories.

- Growth areas…

- Consumer payments – digitizing the $18 trillion spent in cash and check globally. Continuing to grow acceptance (including contactless penetration) and grow credentials with traditional issuers, fintechs and wallets.

- New Flows – $185 trillion in B2B, P2P, B2C and G2C. P2P, which represents $20 trillion of the opp., was Visa Direct’s first use case and continues to grow substantially. A key area of future growth is cross-border P2P, or remittance. Four of the top five global money transfer operators were onboarded in fiscal year 2020, TransferWise, Western Union, Remitly, and MoneyGram. In B2B, Goldman Sachs recently signed on to Visa’s B2B Connect for cross-border B2B money movement w/ corporate clients.

- Value-added services – a few services with notable progress this quarter. As e-commerce explodes, interest in Cybersource remains strong for merchants, as well as from fintechs and acquirers looking to leverage Visa’s capabilities. This quarter, two additional leading acquirers signed on to use Cybersource, KBank in Thailand and NAB in Australia.

- Spend categories – across categories, growth was relatively consistent with the prior quarter. Categories which have been growing above their pre-COVID levels have remained elevated including food and drugstores, home improvement, and retail goods. For categories that are the hardest hit by this pandemic including travel, entertainment, fuel and restaurants, spending remained depressed with year-over-year declines consistent with last quarter.

While COVID has been a headwind for Visa, particularly in cross border volumes – the long-term thesis is intact. Visa is a high moat, duopoly company with extremely high FCF margins (approaching 50%), strong balance sheet and continued runway for secular growth driven by the shift from cash to card/digital payments. Trading at >3% FCF yield.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$V.US

[category earnings]

[tag V]