DBLTX Commentary – Q4 2020

Thesis

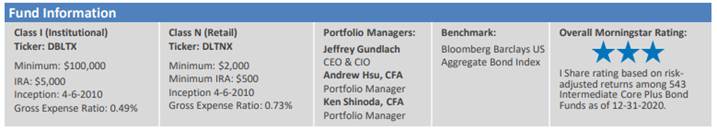

DBLTX utilizes a top down-bottom up process that focuses on MBS and Agency bonds. When compared to the benchmark (Barclays U.S. AGG), the holdings have lower duration and exposure to corporate bonds, reducing their sensitivity to interest rate movements and credit spreads. We expect attractive risk-adjusted return characteristics over the long term from DBLTX, especially during periods when corporate bonds’ spread increase and the yield curve steepens.

[more]

Overview

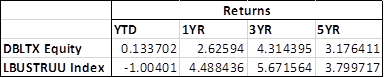

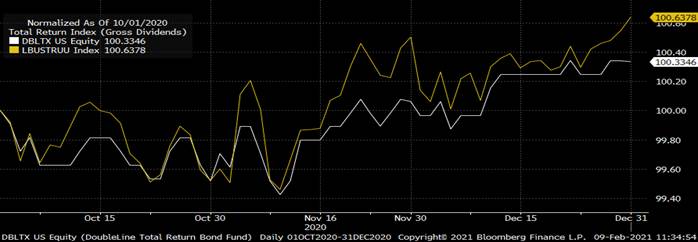

In the fourth quarter of 2020, DBLTX underperformed the benchmark (Barclays U.S. AGG) by 24bps, largely due to asset allocation within the securitized credit sectors – investment grade corporate bonds in the index outperformed. Yet, each sector within the fund generated positive returns, with commercial mortgage-backed securities and asset-backed securities performing best. CLOs and non-Agency RMBS also contributed to returns, yet minimally as they had already spiked back in the summer. Agency MBS was the only sector the detracted from performance due to a steepening curve and an investor focus on credit risk assets.

Q4 2020 Summary

- DBLTX returned 0.43%, while the U.S. AGG returned 0.67%

- Quarter-end effective duration for DBLTX was 3.33 and 6.22 for the U.S. AGG

- The top two performers were commercial MBS and non-Agency CMBS

Both were under substantial pressure due to the pandemic, but spiked once there was positive vaccine news

Both were under substantial pressure due to the pandemic, but spiked once there was positive vaccine news

Outlook

- We continue to hold this fund due to the approach and strong diversification factor within our core bond holdings – yet we are looking further into the holding as the year-to-date volatility and underperformance has made us reassess the approach

- DBLTX is a good position to hold due to its low duration which outperforms during periods of rising rates – Treasury yields were at all time lows in 2020, but have recently been steepening which is good news for DBLTX

- Historically, DBLTX has displayed stronger returns and lower volatility than the index

- DBLTX has had consistent strategy, allocation focus, and sector distribution

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109