Applied Finance Select Fund Commentary – Q4 2020

Thesis

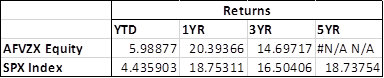

AFVZX is our only active manager in the large cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding roughly 50 companies. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[more]

Overview

In the fourth quarter of 2020, AFVZX outperformed the benchmark (S&P 500 Index) by 510bps largely due to strong allocation and stock selection in Consumer Discretionary, REITs, Financials, and Healthcare. 10 of the 11 sectors outperformed the index, while Energy was that only sector that underperformed and detracted from returns. The overall favoritism towards large cap stocks during 2020 greatly detracted from returns – the fund has large weights to smaller cap names compared to the index.

Q4 2020 Summary

- AFVZX returned 17.25%, while the S&P 500 Index returned 12.15%

- No changes to the fund during the quarter – ALXN has agreed to acquire AZN in December 2021 and management plans to replace this name prior to the acquisition

- Top contributors

- Consumer Discretionary – APTV & LKQ

- REIT – HST

- Financials – JPM & BAC

- Health Care – CVS, MCK, SYK

- Top detractors

- Energy – CVX, COP, VLO

- Health Care – TMO & DHR

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

- The team believes the market is richly valued and can see improvements in valuations

- Faster than expected growth rate in economy

- Higher than expected margin surprise for stocks

- Weary of market growth and its continued rally with the abundance of stimulus that has been borrowed and rolled out

- The continuation of the virus, vaccine distribution, and the implementation of Biden’s policies – especially on taxes and the “green” movement – could caused prolonged volatility

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109