Current Price: $133 Price Target: $157

Position Size: 7.2% TTM Performance: +85%

Key Takeaways:

- Strong beat across product segments – revenue record in each geographic segment and strong double-digit growth in each product category

- Big improvement in China – 87% YoY growth; lapping earlier lockdowns than US.

- Increased buyback – added $90B to the existing share repurchase program.

- Upping investment in US plans – took their 5 yr. target spend from $350B to $430B – investments will “create 20K jobs” and support “American innovation and drive economic benefits,” including a new North Carolina campus and investments in silicon engineering and 5G technology.

- No specific guidance again – June quarter revenue is expected to be up strong double digits, which includes a negative supply constraint impact of $3 billion to $4 billion (semi shortages primarily affecting the iPad and the Mac).

- CEO Tim Cook said, “If you look at how the iPhone did around the world, we had the top five models of smartphone in the US, the top two in urban China, four out of the top five in Japan, the top four in the UK and the top six in Australia. And so it was a sort of across the board in some really key countries, we did really, really well. I do think that the 5G cycle is important. And we’re in the early days of it…”

Additional highlights:

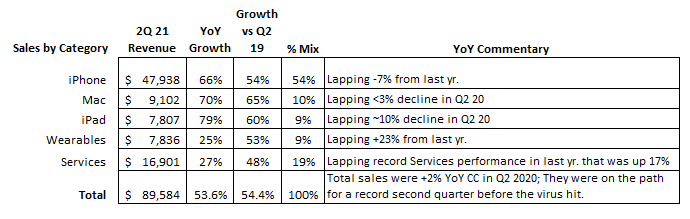

- This impressive growth is not just about lapping easy compares – They saw incredible growth across all product categories this quarter, but not b/c demand collapsed last yr. Covid did have a negative impact last year, particularly w/ iPhones and especially in China where lockdowns occurred earlier, but overall 2Q sales were up slightly last year driven by services and wearables. And sales in each product category this quarter were all well ahead of Q2 2019. See chart below for segment growth details.

- iPhone – Sales were up 66% vs last yr and up 54% vs Q2 2019. iPhone 12 was a key growth driver and lapping China shut down. Saw a record number of upgraders for a March quarter. Later launch of new iPhone models also shifted some demand to this quarter.

- Mac – the last three quarters for Mac have been its three best quarters ever fueled by the M1 chip. Just announced redesigned Macs – the first major change to the computer’s exterior since 2012.

- iPad – grew very strong double digits to its highest March quarter revenue in nearly a decade. Just announced iPad w/ M1 chip and 5G.

- Wearables – strong performance from both Apple Watch Series 6 and Apple Watch SE. Just announced air tags and new Apple TV 4K

- Services – record quarter in each geography; now at 660m subs, up 145m from last yr. Just introduced Apple Card family and adding podcast subscriptions. Saw a return to growth on Apple Care as stores have re-opened.

- Putting in perspective growing installed base & new chips – Apple continues to significantly expand their installed base. And they have multiple new products being launched and more in the pipeline (e.g. AR glasses, Apple car) that could be key drivers of LT growth….and, importantly, a growing services business tied to all these products. Part of what differentiates Apple is they design their own silicon for the processor chips that are the brains of their iPhones and iPads and now their Macs, which gives them better control over performance and feature integration in their devices. This has proven to give them an advantage with the way they design their products and an advantage with developers. So, now they have Macs, iPhones and iPads running the same underlying technology which should make it easier for Apple to unify its apps ecosystem, including allowing iPhone and iPad apps to run on Macs. This advantage and the relevance of their ecosystem gets more and more important as computing power in phones increases, 5G delivers better connectivity and, as a result, we have the ability to use their devices in enhanced ways (w/ increased revenue opportunities) ….like apps that take advantage of augmented reality and IoT related technologies.

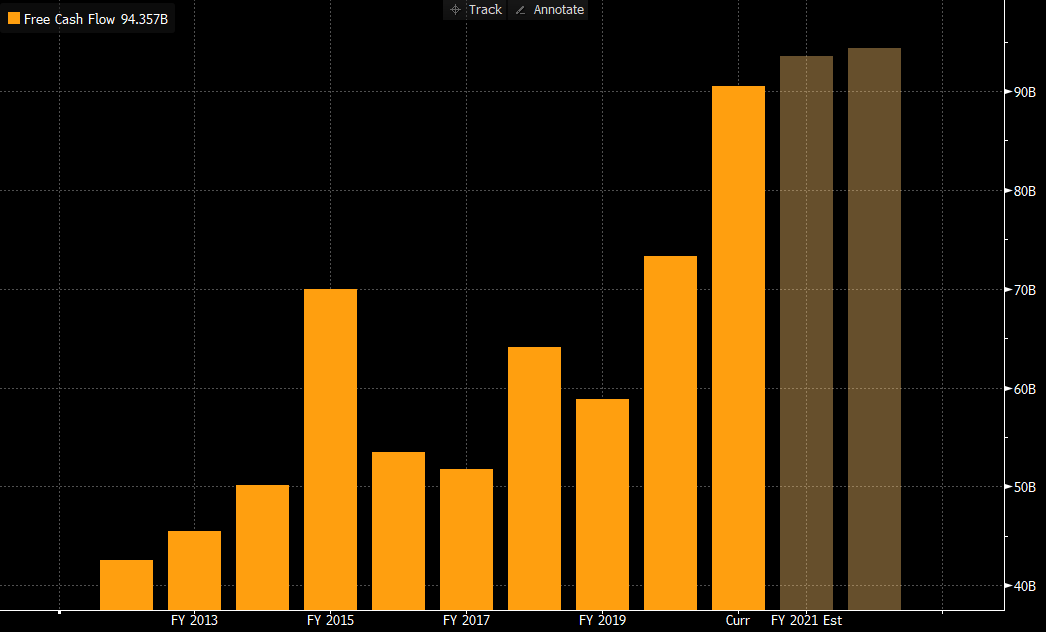

- Despite increase in price, Apple is still not expensive…

- Trading at 4.1% FCF yield on 2021 and a 0.7% dividend yield w/ another >4% of their market cap in net cash on their balance sheet.

- For reference, pre-pandemic in Jan 2020, Apple was trading at ~4.7% FCF yield and 1% dividend yield with ~7% of their market cap in net cash.

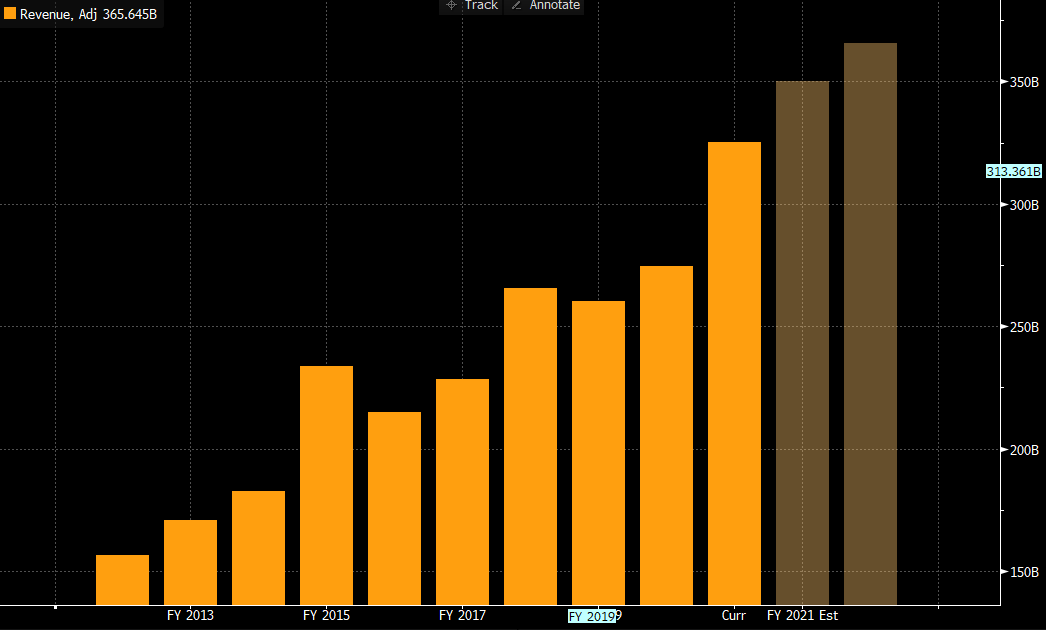

- For the full year 2021 (ends in Sept) and for 2022, the growth trajectory for revenue and for FCF has steepened from the last few years. See charts below. “Curr” = trailing twelve months.

$AAPL.US

[category earnings]

[tag AAPL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109