Key Takeaways:

Current price: $194 Price target: $236

Position size: 2.54% 1-year performance: +28%

- Top line flat y/y, missing consensus as the recovery in core business is slow to pick up and ventilator sales no longer tailwind (and also provide tough comparison y/y)

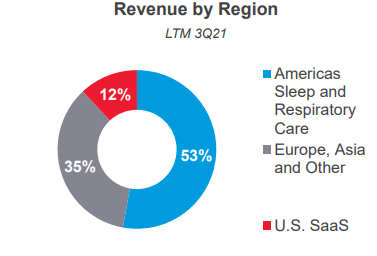

- Adjusting for the $35M sales in ventilators last quarter (due to covid) – sales growth would have been +1% (mostly outside of the US at +6%, as the US benefited less from ventilator sales)

- No ventilators sales this quarter, as previously guided

- New patients starts still struggling with the pandemic to recover, but sequential improvements into April in the US

- US devices sales were -2% despite market share gains from competitors facing supply issues

- Pent-up demand will be met with more at-home testing – likely to come back over time rather than all at once

- Rest of world devices sales still impacted by Covid/lockdowns -18% (ex-FX) – especially large markets in France & Germany

- Masks resupply program still resilient

- US masks sales +7% lifted by resupply but facing tough y/y comps as last year saw beginning of customer stocking

- Ex-US market flat

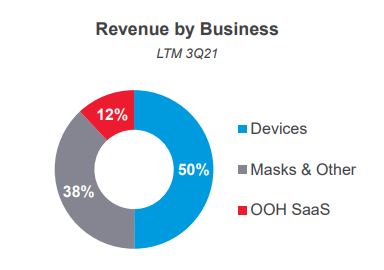

- Software-as-a-service business: 5% growth with stabilization trend in patient flow in out-of-hospital setting

- The Agency for Healthcare Research & Quality (AHRQ) report publish on April 1 shows draft finding on CPAP therapy being not positive, but Resmed believes it is lacking real world outcomes, and the American Academy of Sleep Medicine thinks they did not use all available evidence – final report should come before year-end. This is important as reimbursement adjustments could be made pending this report.

- Gross margin fell slightly by 40bps y/y due to mix impact (less ventilator sales), transition to a new site in Singapore and higher freight costs

- To offset that, SG&A fell 7%, thanks to lower travel expenses and cost management strategy

- $255M in tax reserves for a proposed settlement with the Australian Tax Office related to prior transfer pricing issues

- Operating cash flow was lower y/y due to working capital requirements

- Buyback likely to start again in FY22

- Guidance for next quarter is for low single digits growth sequentially

- FY22 guidance: double digit revenue growth in 2H2022, thanks to new product launch (AirSense 11) – guidance this early is unusual but needed to clarify the impact of ventilator sales from Covid, and recovery in core business from there.

Our long-term view on the stock is still valid, with the global sleep apnea market only ~20-30% penetrated, and market volume growth rate ~10% per year – an attractive market where Resmed and Philips play in duopoly. This temporary set back is a bump on the road and we believe Resmed will performance well as the world reopens post-Covid, with greater emphasis on respiratory health.

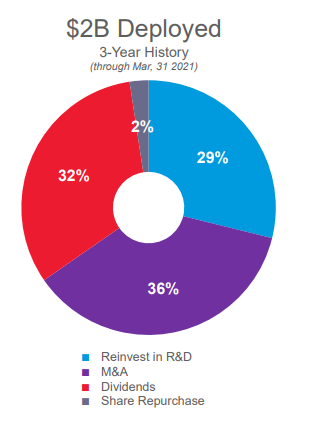

Capital allocation remains on track with long-term targets announced by management:

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[category earnings] [category equity research] [tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109