TIAA-CREF Real Estate Fund Commentary – Q1 2021

Thesis

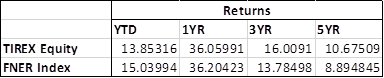

TIREX utilizes fundamental research to find properties in high barrier markets, with higher occupancy and rent growth. By focusing on quality companies and avoiding unnecessary risks, the fund obtains a strong track record that has outperformed the benchmark and REIT ETF over time. We continue to hold TIREX because of the team’s growth focus with asset concentrations in supply constrained markets. Lastly, TIREX was the lowest cost active manager screened, at 51bps.

[more]

Overview

In the first quarter of 2021, TIREX underperformed the benchmark (FTSE Nareit All Equity REITs Index) by 49bps, driven by a few holdings that did not benefit as much from the U.S. economy reopening. Yet, the fund did outperform broad-market U.S. equity indexes due to strong gains in retail, lodging/resorts, and apartments. “Shelter-at-home” sectors such as industrials, timber, and data centers acted as headwinds during the quarter. Going forward, the fund is looking to allocate more to apartments and regional malls, while reducing exposure to data centers and industrial property types.

Q1 2021 Summary

- TIREX returned 7.83%, while the FTSE Nareit All Equity REITs Index returned 8.32%

- Contributors

- Simon Property Group Inc. – country’s largest regional mall REIT

- SITE Centers Corp – shopping center REIT

- Equity Residential – apartment REIT

- Detractors

- GDS Holdings Ltd – China-based data center

- Megaport Ltd. – Australia-based network-software interconnection services company

- Sun Communities, Inc. – housing REIT

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s goal to obtain long-term alpha through capital appreciation and current income

- By having a research-oriented investment process that focuses on cash flows and asset values we believe TIREX will continue to outperform its benchmark long-term

- The managers are effective when it comes to understanding and preparing for changes to the REIT landscape and where long-term sustainable growth exists

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109