Harding Loevner Emerging Market Fund Commentary – Q1 2021

Thesis

HLMEX utilizes fundamental research to find companies with strong quality and growth metrics that can be compared across the global landscape. By focusing on investments with competitive advantages, long-term growth potential, quality management, and corporate strength, HLMEX offers diversity to our EM allocation while generating alpha over the long run. We continue to hold the fund because of the team’s conviction in high quality companies and managed risk through diversification and evaluation.

[more]

Overview

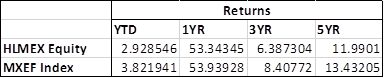

In the first quarter of 2021, HLMEX underperformed the benchmark (MSCI Emerging Markets Index) by 57bps largely due to allocation to Financials, specifically across Latin America. Selection in Communication Services and lack of exposure to Utilities also detracted from overall performance. Energy and Information Technology on the other hand contributed to returns. Poor stock selection in India, overweight to Brazil, and lack of exposure to Saudi Arabia hurt returns. Underexposure to China and strong selection in Russia, though, helped returns.

Q1 2021 Summary

- HLMEX returned 1.72%, while the MSCI Emerging Markets Index returned 2.29%

- Contributors

- Novatek, Techtronic Industries, Hon Hai Precision, EPAM, and Lukoil

- Detractors

- Midea Group, New Oriental, Localiza, LG Household & Health Care, and CD Projekt

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s focus on quality by emphasizing earnings growth and strong cash flow to gain attractive returns over the long run

- Global determination to improve climate, especially through electric vehicles

- The fund has increased its upper limit for China and Hong Kong to the higher of China’s weight in the MSCI EM Index or 35%

- Continue to invest in durable growth – quality focus with attractive valuations

- Only purchase this quarter was CGS (Country Garden Services), a property management company

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109