Current price: $287 Price target: $310

Position size: 3.6% TTM Performance: 38%

Key Takeaways:

- Slight miss on lower DIY demand which is normalizing after pandemic driven surge. Increased demand from Pros, commercial and industrial are offsetting. Consolidated net sales increased 17% w/ SSS of 19%.

- Overall demand environment continues to be strong – strong housing market and improving industrial end markets bode well for demand.

- Raised prices to offset rising raw material costs – saw GM pressure in the quarter (320bps; SG&A leverage partially offset), but committed to fully passing through higher raw materials which they now expect to be mid-teens for the year.

- No change to outlook despite slight miss

- CEO John Morikis said, “I’ve got great confidence that as we come out of this, you’re going to see that same coiled spring that we’ve exited other challenging times uncoil and we’re going to accelerate that… as our competitors continue to close stores and close territories and we continue to invest in a number of areas. We’re going to take advantage of this market and we actually, as difficult as these times are, these are the best times for our company.”

Additional Highlights:

- Revenue and margin headwinds will subside…

- Supply chain disruptions are temporary headwind to growth – saw an 3.5% drag on revenue growth from the “Uri” winter storm in Feb that impacted the complex Petrochemical supply chain. Impact split evenly across the Americas Group and the Consumer Brands Group.

- Gross Margins will improve – similar to past cycles, price increases come at a lag to higher raw material costs which are 80-85% of COGS for paint. The result is a near term hit to gross margins, but they will maintain pricing and see gross margins expand as some of the temporary drivers to higher commodity costs recede.

- This environment may improve their competitive positioning and client/partner relationships…

- “We’re leveraging all of our assets, including our store platform, our fleet, our distribution centers and more, to let us come up with unique and creative customer solutions that others simply can’t”…” We are unique in the fact that we have our own fleet of vehicles, we have 860 tractors and 2,100 trailers that we use to expedite these raw materials into our plants and in many cases right now from our plans to customer projects, so it’s the entire supply chain… working to expedite and cut out as many days as possible.”

- America’s Group ($3.1B), +23%:

- Same store sales increased 19.3% (lapping a -7%)

- Sales in all end markets, except DIY, were up double-digits led by residential repaint, commercial and property maintenance that more than offset the decrease in DIY. As expected, sales to DIY customers were down double-digits, driven by difficult comparisons.

- Contractors are reporting solid backlogs. Fourth consecutive quarter spray equipment sales increased by double digits. This continues to be a very healthy sign of recovery as contractors typically invest in this type of equipment in anticipation of solid demand.

- Consumer Brands Group ($732m), -25%:

- Lower DIY demand was a big drag (but is their smallest segment) resulting in lower sales volumes to their retail customers – this was partially offset by selling price increases. Also saw a 4% drag from a divestiture.

- The Performance Coatings Group ($1.6B), +41%:

- All divisions in this industrial focused segment delivered strong double-digit growth, led by industrial wood and general industrial

- Positive trends in new residential construction are driving increased demand for kitchen cabinetry, flooring, and furniture.

- Guidance: “While we are very encouraged with our strong start to the year in a seasonally smaller quarter and continuing strength in the demand environment, our full year adjusted earnings guidance remains unchanged given the near-term uncertainty of raw material availability and cost inflation. Despite the uncertainties, our businesses are extremely well positioned, and we remain confident in our long-term ability to grow faster than the market.”

- Balance sheet remains strong – leverage ratio is ~2.5x.

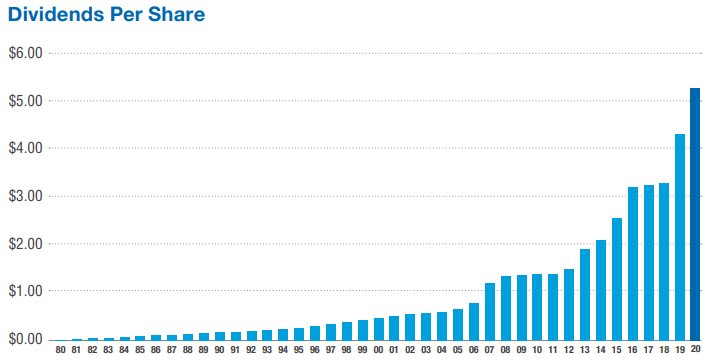

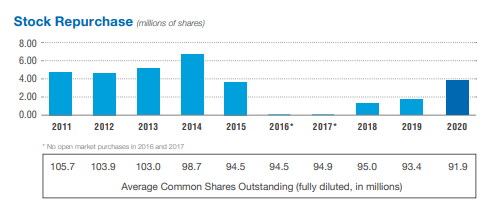

- Strong history of returning capital to shareholders continues – In 2020, they increased their dividend 19%, marking the 42nd consecutive year they increased their dividend. They’ve also bought back 6.4m shares YTD.

- Reasonable valuation – trading at ~3.5% forward FCF yield.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$SHW.US

[category earnings]

[tag SHW]