Current Price: $146 Price Target: $157

Position Size: 7.5% TTM Performance: +57%

Key Takeaways:

- Strong beat across all products & services – revenue up 36% and profits almost doubled

- China continues to be strong – +58% YoY growth. Set a June quarter revenue record and significantly growing the installed base. In greater China, 85% of Apple Watch buyers were new to the product and 66% of Mac and iPad buyers were new.

- No specific guidance again – Growth this Q will be lower than last quarter’s 36% b/c of Fx, greater supply constraints and lapping a more difficult Services compare. The constraints will primarily impact iPhone and iPad.

Additional highlights:

- Seeing broad based growth – set new June quarter records in almost every product segment (iPad was highest in a decade, for everything else it was a record June Q) and in every geographic region with very strong double digit growth in each one of them.

- iPhone – up +50% YoY. The iPhone 12 family continues to be in very high demand. Installed base is >1 billion devices.

- Mac – the last four quarters for Mac have been its best four quarters ever. Revenues were up 16% YoY despite supply constraints.

- iPad – up 12% in spite of significant supply constraints. Started shipping iPad Pro powered by the M1 chip.

- Wearables – grew 36% YoY. Nearly 75% of Apple Watch buyers were new to the product. This quarter, they began shipping AirTags – their new stalking device. JK.

- Strong Services growth driven by growing installed base –

- Revenue +33% YoY; set a new all-time revenue record.

- Mix shift towards Services drove 80bps in GM expansion to 43.3%.

- Now at 700m subs, up 150m from last yr. 4x the number of subs they had 4 yrs. ago.

- Introduced Apple Podcast subscriptions.

- Apple TV + was the recipient of 35 Emmy nominations this year, which speaks to the quality of their programming (Ted Lasso is excellent if you haven’t seen it!).

- 5G upgrade cycle on the horizon – only in the early innings of 5G. If you look at their 5G penetration around the world, there is only a couple of countries that are in the double digits yet.

- Growing installed base is key positive – this drives their virtuous cycle. More users of their devices lures developers to create better apps which lures more users. This is key to their LT growth. Apple continues to significantly expand their installed base. And they have multiple new products being launched and more in the pipeline (e.g. AR glasses, Apple car) that could be key drivers of LT growth….and, importantly, a growing services business tied to all these products. Part of what differentiates Apple is they design their own silicon for the processor chips that are the brains of their iPhones and iPads and now their Macs, which gives them better control over performance and feature integration in their devices. This has proven to give them an advantage with the way they design their products and an advantage with developers. So, now they have Macs, iPhones and iPads running the same underlying technology which should make it easier for Apple to unify its apps ecosystem, including allowing iPhone and iPad apps to run on Macs. This advantage and the relevance of their ecosystem gets more and more important as computing power in phones increases, 5G delivers better connectivity and, as a result, we have the ability to use their devices in enhanced ways (w/ increased revenue opportunities) ….like apps that take advantage of augmented reality and IoT related technologies.

- Despite increase in price, Apple is still not expensive…

- Trading at >4% FCF yield on 2021 (in line w/ S&P) and a 0.6% dividend yield w/ another 3% of their market cap ($72B) in net cash on their balance sheet.

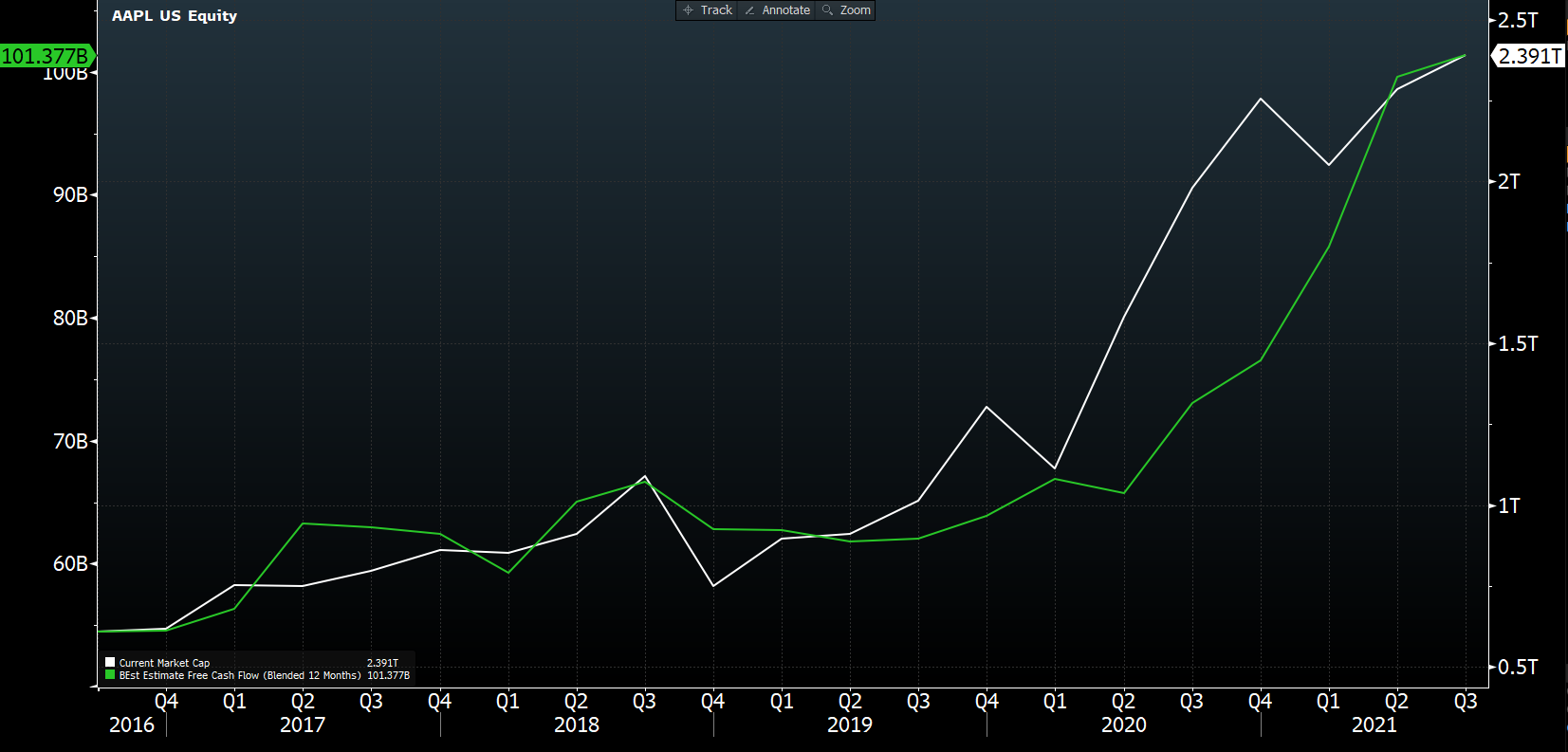

- Their market cap has been tracking their massive increase in FCF estimates. See chart below – the green line (left scale) is forward 12 month FCF estimate.

- For reference, pre-pandemic in Jan 2020, Apple was trading at ~4.7% FCF yield and 1% dividend yield with ~7% of their market cap in net cash.

- Huge amount of cash on their balance sheet w/ years of buybacks to support valuation

- Capital returns may need to expand further to hit their net-cash-neutral target in a few years.

- With current net cash of ~$72B and expectations of >$450B of FCF over the next 5 years, shareholder returns could be ~$500B or >20% of their current market cap.

- They’ve returned >$530B since 2012. So, from 2012 to 2026, they may return >$1T.

$AAPL.US

[category earnings]

[tag AAPL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109