Westwood SmallCap Fund Commentary – Q2 2021

Thesis

WHGSX is our only active manager in the small cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding between 60 and 80 companies. By utilizing bottom-up fundamentals and focusing on companies with strong balance sheets, high ROIC, and consistently high FCF yield, the fund generates alpha especially during market downturns. We continue to hold WHGSX because of the team’s ability to find cheap valued stocks in the small cap space enabling them to generate strong returns over the long run.

[more]

Overview

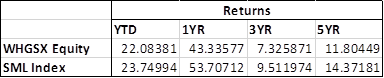

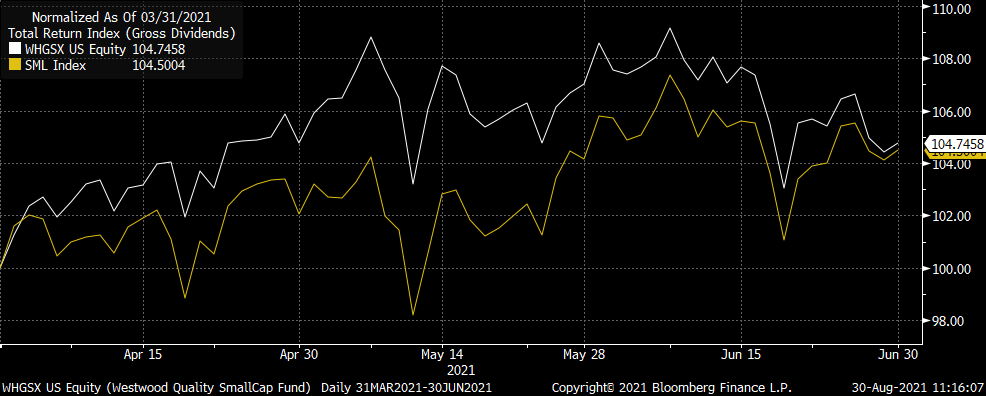

In the second quarter of 2021, WHGSX outperformed the benchmark (S&P 600 Index) by 25bps largely due to strong security selection. Cyclicals greatly contributed to performance, with Industrials and Financials leading the way. Stock selection in these sectors specifically helped the fund outperform the index. Communication Services and Materials detracted from returns. In general, high valuation companies that saw strong returns in 2020 and the previous quarter were a headwind for the asset class.

Q2 2021 Summary

- WHGSX returned 4.75%, while the S&P 600 Index returned 4.50%

- Industrials – leading contributor due to favorable selection

- Office furniture manufacturing agreed to be acquired at a significant premium

- Businesses focused on motion control and suppliers of residential and commercial wire

- Financials – strong activity levels in capital markets helped boost performance

- Investment banks seeing record advisory revenues and increasing interest in growing deal making business

- Regional banks with unique exposures (ie. Mortgage lending and agricultural loan portfolios)

- Communication Services – leading detractor due to lack of meme stock exposure

- Now owning a movie theatre chain that saw extremely high returns for the quarter

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the value and quality tilt strategy that has a bottom-up, fundamental focus around ROIC, FCF yields, balance sheet metrics, and companies trading at a discount

- Extremely high valuation companies that acted as a headwind will moderate and the importance of fundamental data starts to dominate investors’ decision making

- Return to offices and a need to raise more capital will continue to be a tailwind for the fund

- The fund will continue to focus on quality companies that are trading at a relatively attractive valuation – strong return and cash generation

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109