Atlanta Capital Focused Growth Commentary – Q2 2021

Thesis

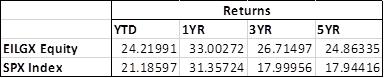

EILGX serves as our active manager in the large cap “growth” U.S. equity markets and follows a concentrated (20-30 companies) investment strategy with a heavy quality tilt emphasizing companies with high ROIC, strong cash flow multiples, and long-term moats. By utilizing DCF models and bottom-up fundamentals, the fund finds stocks with secular tailwinds, sustainable financials, and relatively low downside capture to generate alpha over the S&P 500 Index over time. We continue to hold EILGX because of the team’s ability to build a concentrated portfolio that gives our U.S. large-cap allocation a strong quality tilt, while giving clients strong risk-adjusted returns.

[more]

Overview

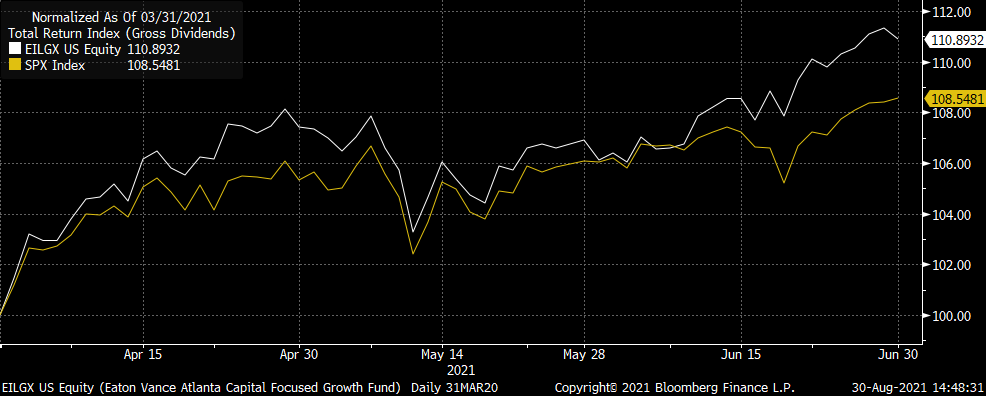

In the second quarter of 2021, EILGX outperformed the benchmark (S&P 500 Index) by 234bps due to strong stock selection in Healthcare and Communication Services. Additionally, underweights to Consumer Staples and Consumer Discretionary contributed to performance. Offsetting these results, though, was poor selection within Information Technology, Materials, and Consumer Discretionary. An overweight to Materials and underweight to Information Technology also acted as a drag on returns. In general, U.S. large cap stocks saw a trade between growth and value, with growth providing stronger returns for the quarter compared to value.

Q2 2021 Summary

- EILGX returned 10.89%, while the S&P 500 Index returned 8.55%

- Top contributors

- Intuit Inc. – financials software

- Danaher Corp. – medical equipment company

- Gartner – IT services firm

- Alphabet – online search platform

- Lack of exposure to Tesla – electric vehicle maker

- Top detractors

- Fiserv, Inc. – global fintech company

- Ecolab Inc. – chemical company

- Verisk Analytics – data analytics provider

- TJX Companies – off-price retailer

- Lack of exposure to NVIDIA Corp. – semiconductor company

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index through full market cycles while maintaining a strong quality strategy and growth tilt

- Market concentration continues to be a risk

- Information Technology, Consumer Discretionary, and Communication Services make up more than 75% of the Russell 1000 Growth Index

- Sticking with companies that have demonstrated a track record of consistent growth and earnings stability may provide a “margin of safety” that becomes increasingly valuable during times of rising uncertainty

- Believe the fund’s holdings, which have sustainable earnings growth, will be able to withstand different market environments

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109