Key Takeaways:

Current Price: $82.6 Price Target: $102

Position size: 2.05% 1-Year Performance: -14%

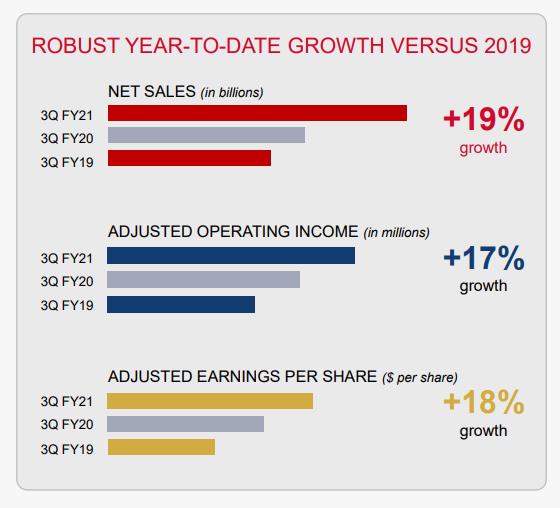

- Revenue growth remains elevated thanks to recovery in Flavor Solutions (+20.6%), while Consumers laps last year’s high demand (+1.2% this quarter).

- Packaged food companies having high demand

- Away-from-home is recovering as people go back to the office

- Integrating 2 recent acquisitions: Fona and Cholula

- Inflation expected to continue to be a challenge going into next year for packaging, transportation and labor costs.

- Expects labor costs to remain elevated, now being a new baseline, don’t expect salaries to come back down over time, but increase to moderate sometime next year.

- Pricing and some costs management will offset higher inflation in the coming 2 quarters

- ERP replacement program that had been delayed during early pandemic is back on track, will increase expenses by $350-400M

- Guidance for the year adjusted:

- Sales growth of 12-13% (from 11-13%)

- Mid-single digits cost inflation is pushing operating income growth down from 10-12% to 6-8%

- EPS growth of +5% to +7% (lowered from +6-8%)

- Long-term thesis is intact. We see the inflation situation and pressure on margin as a temporary impact, as the company will raise prices to offset a major portion of it (showing pricing power as a market leader).

- CEO quote: “the packaged food industry is experiencing the highest inflationary period of the last decade, or even two“.

The Thesis on MKC:

- Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

- Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

- Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

- Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$US.MKC

[tag MKC]

[category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109