Current price: $318 Price target: $330

Position size: 4% TTM Performance: 38%

Key Takeaways:

- Results being weighed on by supply chain constraints that are resulting in raw materials shortages. Mgmt. had already cut guidance in the beginning of September.

- Price increases are lagging higher raw materials costs which is weighing on margins now, but will improve. Committed to fully passing through higher raw materials which they now expect to be in the low-20’s percent increase for the year vs expectations for mid-teens previously.

- Underlying demand trends continue to be strong and mgmt. feels shortages are starting to improve. Strong housing market and improving industrial end markets bode well for demand.

- DIY demand is normalizing after pandemic driven surge. Increased demand from Pros, commercial and industrial are offsetting.

- Quotes from the call…

- “the demand environment remains robust across our pro architectural and industrial end markets. Many external indicators and, more importantly, our customers remained highly positive. Demand is not the issue“

- “raw material inflation remained persistently high and raw material availability failed to improve.”

- “We are aggressively combating raw material inflation with significant pricing actions across each of our businesses. We implemented multiple price increases in the quarter. We will continue to do so as necessary. We continue to work closely with our suppliers on solutions to improve availability sooner rather than later. At the same time, we’re exploring every avenue to better control our own destiny going forward, including our recent announcement to acquire Specialty Polymers.”

- “we are confident we will see significant margin expansion as availability and inflation headwinds eventually subside.”

Additional Highlights:

- Revenue and margin headwinds will subside…

- Supply chain disruptions are temporary headwind to growth – sales increased 0.5% as raw material availability negatively impacted sales by an estimated high-single-digit percentage.

- Gross Margins will improve – similar to past cycles, price increases come at a lag to higher raw material costs which are 80-85% of COGS for paint. The result is a near term hit to gross margins, but they will maintain pricing and see gross margins expand as some of the temporary drivers to higher commodity costs recede. A 630bps hit to GM was partially offset by 90bps lower SG&A.

- They’re taking action (all of which is aided by their scale & pricing power) – price increases, vertical acquisition (specialty polymers) that will aid supply, and they continue to invest in growth initiatives – they have significant production capacity available today and are bringing 50 million gallons of incremental architectural production capacity online over the next two quarters.

- “We’re leveraging all of our assets, including our store platform, our fleet, our distribution centers and more, to let us come up with unique and creative customer solutions that others simply can’t”…” We are unique in the fact that we have our own fleet of vehicles, we have 860 tractors and 2,100 trailers that we use to expedite these raw materials into our plants and in many cases right now from our plans to customer projects, so it’s the entire supply chain… working to expedite and cut out as many days as possible.”

- America’s Group ($3B), -0.4%:

- Significant raw material availability headwinds; same store sales decreased 2.8%

- Pro architectural demand remains robust; expect delayed projects to be completed with improved product availability.

- DIY sales down double-digits, driven by difficult prior year comparisons and consumers returning to the workplace

- Consumer Brands Group ($647m), -23%:

- Lower DIY demand was a big drag (but is their smallest segment) resulting in lower sales volumes to their retail customers – this was partially offset by selling price increases. Also saw drag from raw material availability and a divestiture.

- The Performance Coatings Group ($1.5B), +17%:

- Sales increased 17.4% with growth in all divisions and regions

- Packaging and General Industrial had highest YoY increases and positive in every region; Coil strength continues globally. Auto Refinish solid as miles driven nearing pre-pandemic levels. Industrial Wood impacted by customer shutdowns in Southeast Asia due to COVID.

- Acquiring Specialty Polymers, should close by year-end – they’re a US based leading manufacturer of water-based polymers used in architectural and industrial coatings. This adds to their existing internal resin manufacturing capability.

- FY Guidance: expect high-single-digits percentage sales increase

- TAG: up high-single-digits percentage

- CBG: down mid-teens percentage – includes negative 4% related to Wattyl divestiture

- PCG: up low-twenties percentage

- Raw materials: up low-twenties percentage

- Continue to expect margin expansion over the long-term and maintain their gross margin target in the 45% to 48% range…from <42% now.

- Balance sheet remains strong – leverage ratio is ~2.6x. Debt is 92% fixed rate.

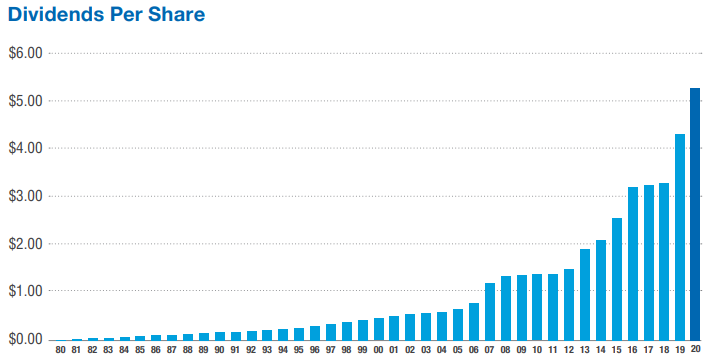

- Strong history of returning capital to shareholders continues – In 2020, they increased their dividend 19%, marking the 42nd consecutive year they increased their dividend.

- Valuation – trading at ~3.1% forward FCF yield.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$SHW.US

[category earnings]

[tag SHW]